Experts said Pakistan needs the payout as soon as possible. “If this drags on for, say, longer than a month, things get more difficult as our forex reserves have reached a critical level,” former central bank deputy governor Murtaza Syed told Reuters.

Fuel crisis: Petrol pumps go dry

Meanwhile, oil companies of Pakistan are on the verge of ‘collapse’ due to a reeling economic crisis and devaluation of the currency as a result of which most of the petrol pumps across the country have ran out of petrol. Some rural areas have not seen fuel supply in more than a month.

The situation appears to be worst in certain large towns such as Lahore, Gujranwala, and Faisalabad, where numerous petrol pumps have reportedly been running on a poor or nonexistent supply of petrol for many days as a result of pressure from the oil marketing companies.

IMF team leaves without deal

The IMF team, which had arrived in Islamabad on January 31 to work out a deal, left Pakistan on Friday.

Pakistan finance ministry officials and the IMF both said the talks did not result in a “board discussion”, a meeting that would have led to the release of the funds that are part of a $6.5 billion bailout that Pakistan signed in 2019.

“Virtual discussions will continue in the coming days,” assured IMF Pakistan mission chief Nathan Porter, adding “considerable progress had been made”.

Finance minister Ishaq Dar said talks had “concluded successfully” and that a draft memorandum on broadly agreed policies had been shared by the lender.

Package repeatedly stalled

The $1.1 billion tranche was initially expected to be paid out last December. In addition to the stalled tranche, $1.4 billion remain of the $6.5 billion bailout programme, which is due to end in June.

Commuters in Pakistan curse Shehbaz Government as fuel prices skyrocket amid soaring inflation

The $6.5 billion bailout package was repeatedly stalled after the former PM Imran Khan-led government backed out on subsidy agreements and failed on its tax collection commitments outlined in the IMF deal. The Shehbaz Sharif-led government resumed the programme last year and received around $1.17 billion in August.

Pakistan govt wary of IMF riders

In order to unlock the latest tranche of funds, the IMF has set out several tough conditions for Pakistan that include market-based exchange rate of local currency, boosting low tax base, ending tax exemptions for the export sector, as well as raising artificially low petrol, electricity and gas prices.

During the policy-level talks, the lender also expressed its reservations over the projections made by Pakistan’s finance ministry over external financing inflows from multilateral, bilateral creditors and commercial loans.

The IMF has also pushed for Pakistan to keep a sustainable amount of US dollars in the bank through guarantees of further support from friendly nations, as well as the World Bank.

The Shehbaz Sharif government, however, has been extremely reluctant in enforcing the IMF’s bailout conditions, especially in an election year. PM Sharif previously called the conditions for the $1.1 billion loan instalment “beyond imagination”.

But after months of holding out, the government began to bow to IMF pressure in mid-January, loosening controls on the rupee (a step that caused the currency to plunge to a record low), and hiking petrol prices by 16%.

The fiscal adjustments demanded by any deal, however, are likely to fuel record high inflation, which hit 27.5% year-on-year in January.

The IMF also highlighted the energy sector’s almost $15 billion debt. Pakistan has submitted a plan to cut the debt in phases though price hikes and dividends from gas companies, but the IMF is demanding a clearer path forward.

Dar also said his government would discuss the fund’s recommendations about energy sector reforms.

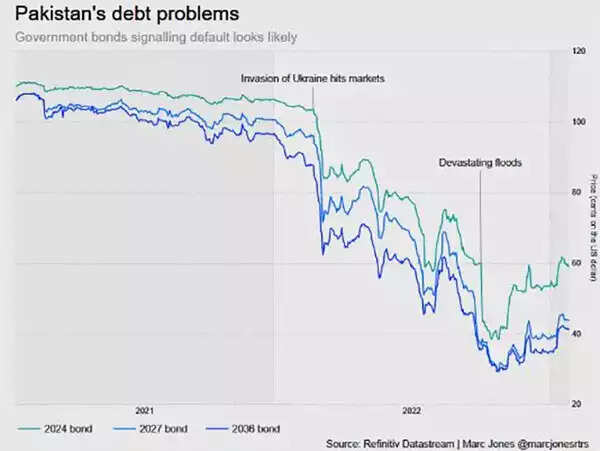

Bankruptcy and default on payments

Analysts have warned that rejecting the conditions could push Pakistan to the brink of bankruptcy and default on external loan repayments.

Pakistan’s economy is in dire straits, stricken by a balance-of-payments crisis as it attempts to service high levels of external debt amid political chaos and deteriorating security.

Inflation has rocketed, the rupee has plummeted and the country can no longer afford imports, causing a severe decline in industry.

The IMF’s loan is critical for Pakistan’s economy as the State Bank of Pakistan-held foreign exchange reserves have dropped to $2.91 billion.

With Pakistan’s reserves declining to such low levels, chances of default against commercial debt rises. In that case, the central bank would refuse repayment to commercial lenders or service their debt.

Since January, Pakistan has not issued letters of credit, except for essential food and medicine, causing a backlog of shipping containers at a Karachi port stuffed with stock the country can no longer afford.

Industries have warned the logjam of cargo would increasingly cause factories to shut, having a cascading effect on employment.

(With inputs from agencies)