MUMBAI: The Mumbai bench of the income tax appellate tribunal (ITAT) has ruled in favour of a Mumbai-based taxpayer, who received Rs 3 crore as a gift from her NRI son, who is a prominent hedge fund operator based in Hong Kong.

While this gift was made in two tranches, via banking channels, the I-T officer questioned the genuineness of the gift and also alleged a circular trading transaction. Thus, the officer sought to tax this sum in the hands of the mother.

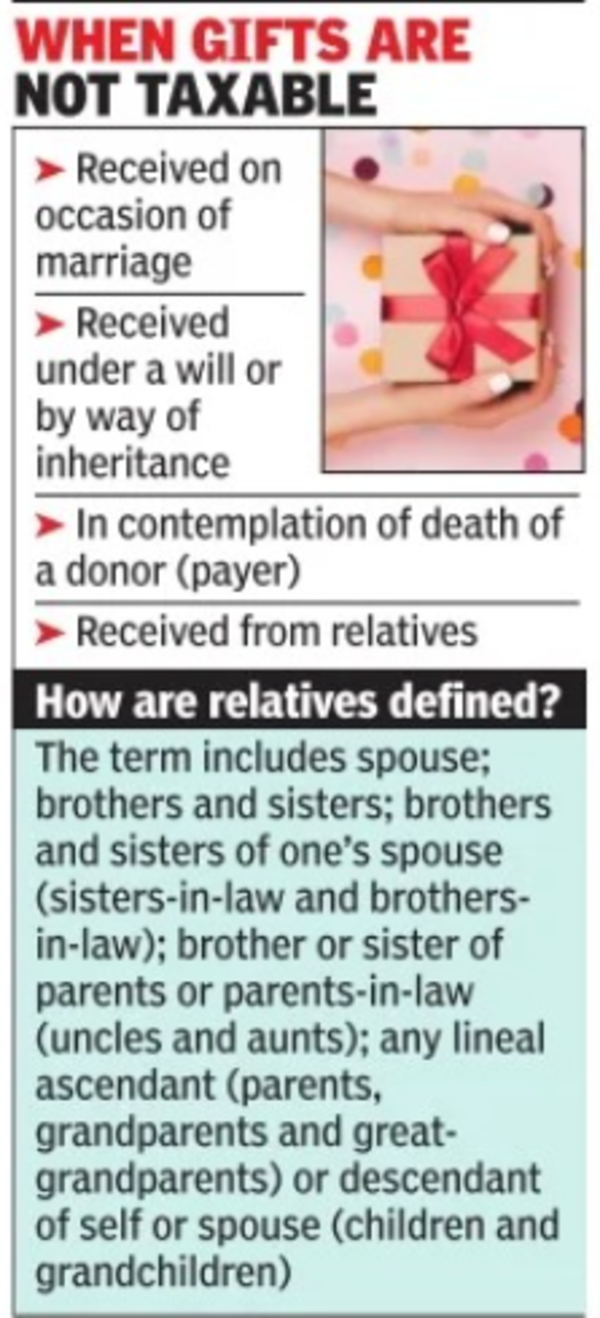

Under the I-T Act, gifts exceeding Rs 50,000—barring for events such as marriage—are generally taxed in the hands of the recipient at the applicable slab rates under the head ‘Income from Other Sources’.

There are exceptions, and gifts made to close relatives are not taxable in the hands of the recipient. However, in this case, the I-T officer treated the Rs 3 crore received by the mother as unexplained cash credit under Section 68 of the I-T Act and sought to tax it in her hands. Tax laws prescribe for a higher rate of 60% (plus cess and surcharge) on sums classified as unexplained cash credit.

This action by the I-T officer was dismissed by the commissioner (appeals), but the I-T department went ahead and filed an appeal with the ITAT. The tribunal concurred with the earlier appellate order and held that the NRI son’s financial capacity to provide the gift was sufficiently demonstrated. His bank account showed adequate funds at the time of executing the gift, thus establishing its creditworthiness.

According to the I-T department, the hedge fund operated by her son was earlier banned by Securities and Exchange Board of India (SEBI) from operating in the Indian market. Further, it said, a subsequent grant of an unsecured loan given by the mother to an Indian company, was a colourable device to invest in the Indian security market—it was a circular trading transaction. The gift amount was received in 2010-11 and in 2012-13, this sum was returned to the son.

The ITAT bench, composed of B R Baskaran (accountant member) and Anikesh Banerjee (judicial member), observed that the details of the bank transfer were submitted to the I-T officer, which clearly showed that the donor had sufficient funds to make the gift. The SEBI order imposing the ban had also been withdrawn. “Despite this, for the purpose of making the addition under Section 68, the I-T officer primarily relied on information sourced from a Google search and local newspaper reports, without conducting any cross-verification or independent inquiry to substantiate the claims,” it said. “The actions of the recipient (mother) of investing the gift amount in an Indian company and subsequently returning the funds to her son are unrelated to the issue of addition under Section 68.”

Ruling in favour of the taxpayer who received the gift, the ITAT bench concluded that the gift transaction was well documented, and the donor’s financial capacity was evident. The I-T department’s claim of a circular transaction was dismissed, with the ITAT bench emphasising that the subsequent use of funds did not affect the legitimacy of the gift.