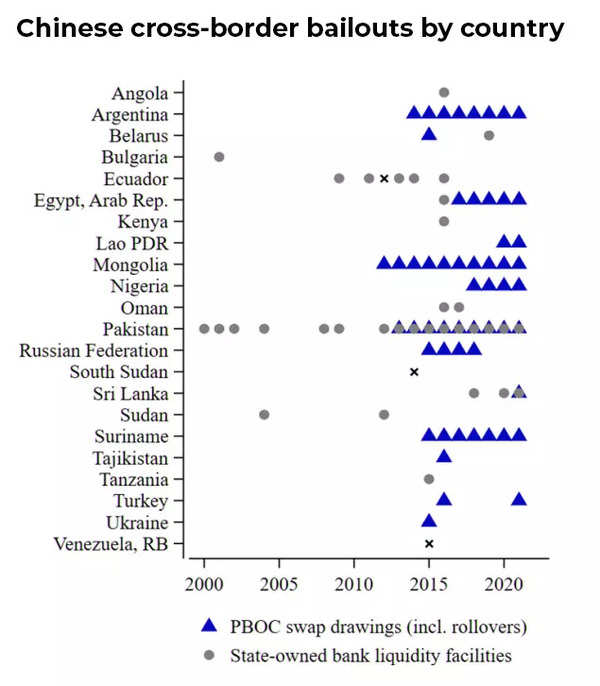

From Sri Lanka to Turkey, China has provided millions of dollars worth of emergency loans to crisis-hit nations in recent years, replacing even the US to become one of the largest lenders in the world, a new study has found.

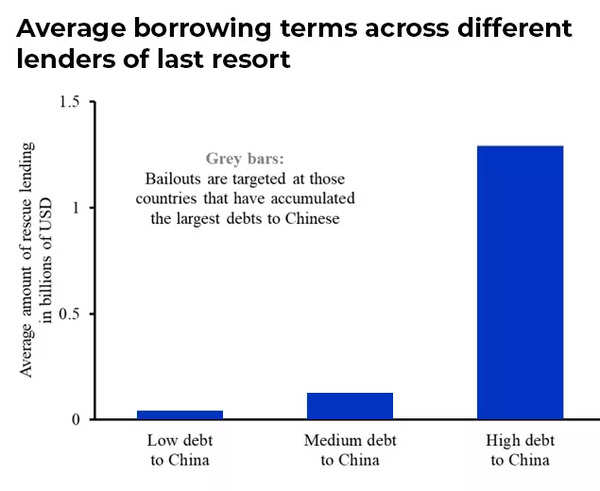

However, unlike the US or IMF, which are well-established global lenders, China has been rescuing mainly low-and-middle income group countries that are part of BRI and owe huge debts.

According to statistics from AidData, a US-based research institute, China has been helping countries that have either geopolitical significance, such as a strategic location, or lots of natural resources.

Many of them have been borrowing heavily from Beijing for years to pay for infrastructure or other projects.

The study said that China has developed a system of “Bailouts on the Belt and Road” that helps recipient

countries to avoid default even as they continue to service their BRI debts, at least in the short run.

According to data, China has effectively replaced US and is fast catching up with IMF in bailing out indebted low- and middle-income countries.

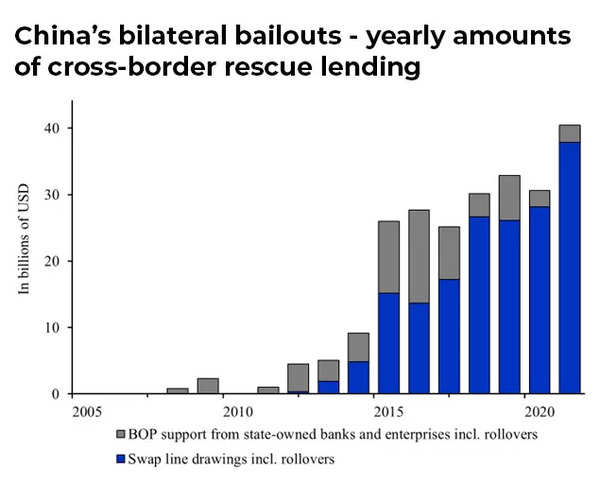

It has provided $240 billion of emergency financing in recent years.

In 2021, China gave $40.5 billion in such loans to distressed countries while IMF lent $68.6 billion to similar nations.

The figures show that China’s emerging position as a “lender of last resort” reflects its evolving status as an economic superpower at a time of global weakness.

However, dozens of countries are struggling to pay their debts, as a slowing economy and rising interest rates push many nations to the brink.

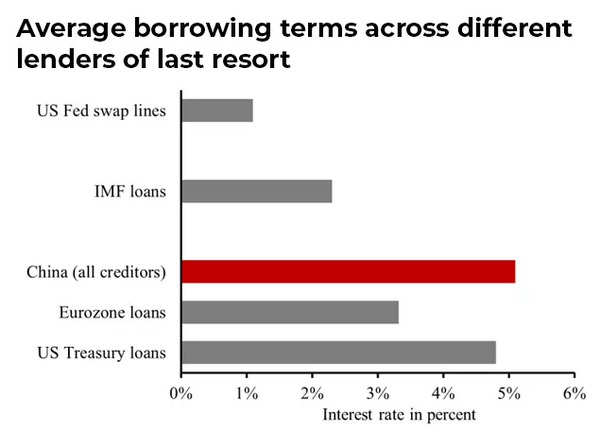

This is because China’s bailouts are not cheap.

China’s central bank has extended loans at adjustable roats and is charging fairly high interest rates from countries like Pakistan, Laos, Nigeria and Suriname. China’s state-owned banks face losses if Beijing does not bail out their borrowers but may profit if other countries manage to stay current on their debt payments.

The country charges an interest rate of 5% for emergency credit to middle-income countries in distress, compared to 2% for IMF rescue loans, the study said.

The US Treasury charged almost the same interest rate as China — 4.8% — when it made rescue loans to middle-income countries in the 1990s through 2002, according to a report on The New York Times.

US officials have often accused China of engaging in “debt trap diplomacy” that is saddling countries with excessive debt for construction projects carried out by Chinese companies.

Furthermore, most of the loans are extended only to middle-income countries considered more important to China’s banking sector. Meanwhile, low-income countries get little to no new money and are offered debt restructuring instead.

“Beijing is ultimately trying to rescue its own banks. That’s why it has gotten into the risky business of international bailout lending,” said study co-author Carmen Reinhart in the AidData post.

Moreover, China’s emergency lending has were in its own currency, the renminbi.

In lending renminbi, Beijing is furthering its efforts to limit reliance on the US dollar as the go-to global currency.

When borrowing renminbi from China’s central bank using so-called swap agreements, the indebted countries then keep the renminbi in their central reserves while spending their dollars to repay foreign debts.