Tag: gst

Self-reliance in focus to counter weaponisation of trade: Piyush Goyal

New Delhi: India is focusing on atmanirbharta (self-reliance) by building capabilities, supply chains and value chains, which will assure that the country will not be…

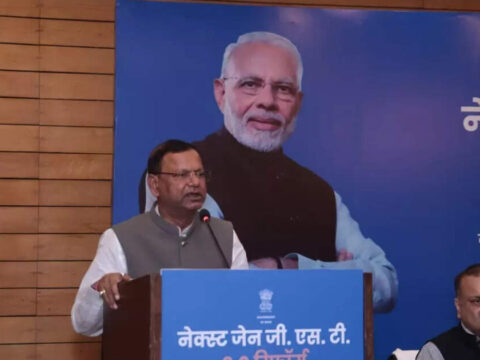

GST reforms will boost market purchasing and economy: MoS Pankaj Chaudhary

The recent GST reforms will spur market consumption and boost the domestic economy, Minister of State for Finance Pankaj Chaudhary said on Monday. He said…

GST on capital goods undermines promise of stable fiscal terms in new oilfield law: Industry to Puri

The recent hike in GST on capital goods used in oil, gas, and coal bed methane sectors undermines the stable contractual and fiscal terms promised…

EY raises India’s FY26 growth forecast to 6.7% on GST 2.0 boost

EY on Monday raised its projection for India’s real GDP growth in FY26 to 6.7%, up from its earlier 6.5% estimate, owing to the recent…

Exporters to get 90% upfront refund only after GST law change

The decision to allow 90% upfront refund for exporters under the goods and services tax (GST) framework may take time to be operationalised as the…

Indian households to experience a relief of 27 to 30% in taxes due to GST 2.0: Report

Households across India will experience a relief of 27 to 30% in taxes due to GST 2.0, according to a joint report by The Federation…

GST reforms will continue, PM Modi says

Prime Minister Narendra Modi on Thursday reiterated that GST reforms will continue further, highlighting the benefits of new GST rate cut. “We have increased the…

FM launches GST appellate tribunal to cut tax litigation

Finance minister Nirmala Sitharaman on Wednesday launched the Goods and Services Tax Appellate Tribunal (GSTAT), a move aimed at reducing tax litigation and providing a…

Landmark GST reforms to boost business, cut prices, drive consumption growth: RBI Bulletin

The Reserve Bank of India Bulletin on Wednesday said that the landmark GST reforms should progressively result in a sustained positive impact through significant gains…

From parotta to caramel popcorn: GST 2.0 ends all classification confusion – The Economic Times Video

GST 2.0 marks a turning point in simplifying India’s indirect tax framework. Gone are the days of debates over whether a parotta is a roti,…