Tag: gst rates

The Year That Was: A year when domestic policy did the heavy lifting| Business News

In terms of economy, 2025 will be remembered as a year where domestic policy acted as a bulwark against external headwinds to growth. Inflation started…

RBI MPC 2025: Malhotra & co. expected to favour repo rate pause after robust Q2 GDP numbers, says SBI Research

The Reserve Bank of India (RBI) is expected to keep the repo rate unchanged at its upcoming December Monetary Policy Committee (MPC) review meeting, given…

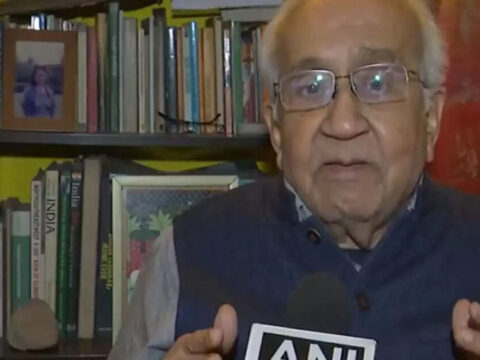

‘We are beginning to see the results’: Economist on India’s 8.2% Q2 GDP growth

India’s economy grew by 8.2 per cent in the second quarter of 2025-26, marking a strong acceleration from last year’s 5.6 per cent growth for…

India’s growth outlook for FY26 remains strong, says Finance Ministry

India’s growth outlook for the current fiscal year remains strong, supported by domestic demand, a favourable monsoon, lower inflation and the recently introduced GST rate…

Direct & indirect tax cuts will improve savings rate in India: Chief Economic Advisor V. Anantha Nageswaran

The direct and indirect tax cuts will improve the savings rate in India, said the Chief Economic Advisor, V. Anantha Nageswaran on Wednesday, as per…

GST 2.0 to boost housing sector, small-scale enterprises: Mines Ministry

The new GST rates and slabs for items related to the mining sector, including marble and granite will have a positive impact on the housing…

‘Ek baar aap GST dekh lo’: PM Modi’s nudge ushered in biggest GST reform in 8 years

Ek baar aap GST dekh lo!’ – Prime Minister Narendra Modi’s gentle nudge to Finance Minister Nirmala Sitharaman in December last year sparked the beginning…

India Inc revenue to grow 7% this fiscal on GST restructuring, but profit margins may remain flat: Crisil

India Inc revenue will likely grow 6-7 per cent this fiscal because of the reduction in the goods and services tax (GST) rates, as per…

New GST rates, coming into effect this Navratri, to boost economy: Ashwini Vaishnaw

The income tax relief provided for in the 2025-26 Budget, coupled with GST rate rationalisation, is set to further push India’s economy to another level,…

GST 2.0 done, what’s the next big reform in Finance Ministry? Sitharaman answers

Union Finance Minister Nirmala Sitharaman reflected on the recently introduced reforms in the goods and services tax (GST) rates, and said it would fuel increased…