Tag: gst council

GST 2.0 to unleash consumption, cushion India’s economy from US tariff headwinds: India Inc

The GST rate rationalisation is set to kick off a cycle of growth for India’s economy, driven by a major consumption boost, and provide much-needed…

Roti, kapda aur makan: The firepower India’s common man got as Diwali gift

Once branded the “Gabbar Singh Tax” for its sting on wallets, GST has gone through a much needed makeover and this time, it’s playing hero…

GST: Once branded Gabbar Singh Tax, it turns out to be Good and Simple Tax

In 2017, nearly four months after the Goods and Services Tax came into effect, Rahul Gandhi, the Congress vice-president, criticised the GST, calling it BJP’s…

New GST rates: Milk, AC, life insurance and other items to become cheaper from Sept 22 | Check details | Latest News India

The Indian government on Wednesday announced a rate cut for the Goods and Services Tax (GST) on hundreds of goods, ranging from cars, washing machines,…

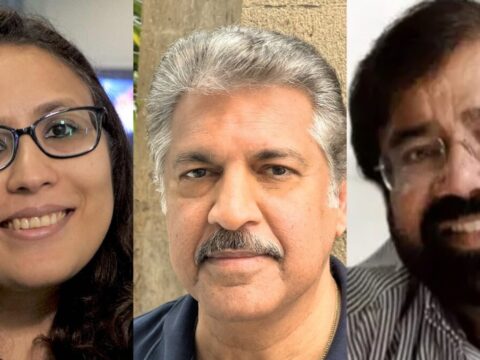

‘Big Diwali gift’: How Indian business leaders reacted to GST Council’s rate cuts bonanza

Indian business leaders, including Radhika Gupta, Harsh Goenka and Anand Mahindra, have welcomed the GST Council’s decision to move to a simplified two-rate structure of…

‘Big Diwali Gift’ | From Anand Mahindra to Harsh Goenka, how India Inc reacted to GST reforms

India has announced sweeping GST rate cuts on hundreds of consumer items—from soaps to small cars—in the biggest indirect tax overhaul since 2017. MD and…

Stock market today: Sensex, Nifty jump 1% each as GST reforms lifts insurance, FMCG, auto stocks

India’s stock market surged today, taking cues from GST reforms that’s set to make soaps to small cars cheaper for the “common man”. A screen…

GST Council approves 2-slab structure: What gets cheaper, what gets costlier | Details | Latest News India

Published on: Sept 04, 2025 07:10 am IST PM Narendra Modi hailed the GST reform, saying it will benefit farmers, MSMEs, traders, and the middle…

Govt delivers ‘GST Diwali bonanza’: Cheaper essentials, big relief on insurance premiums

The Centre and states on Wednesday approved the biggest overhaul of the country’s goods and services tax (GST), eight years after it was launched. The…

Tax cut bonanza cleared in GST regime overhaul | Latest News India

Taxes on goods spanning household essentials, medicines, small cars and appliances will be slashed from September 22 as the GST Council on Wednesday approved the…