Tag: goods and services tax

GST cuts to boost economy, but revenue loss could hit banking sector: Report

While the government has estimated an annual revenue loss of about Rs 480 billion, due to the reduced Goods and Services Tax (GST) rates on…

GST reforms to inject Rs 2 lakh cr into economy, boost demand across sectors

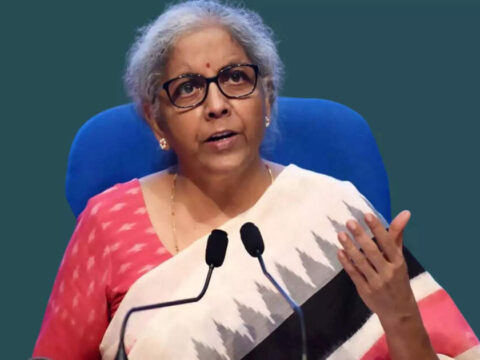

Kolkata: Union Finance Minister Nirmala Sitharaman on Thursday said the latest round of Goods and Services Tax (GST) reforms will pump around Rs 2 lakh…

Indians to soon have Rs 2 lakh crore more cash in hand from GST cuts: Nirmala Sitharaman

Finance Minister Nirmala SItharaman on Wednesday said that the Goods and Services Tax (GST) rejig is set to bring to Rs 2 lakh crore in…

GST 2.0: Key changes effective September 22; explained in FAQs

The 56th GST Council, led by Union Finance Minister Nirmala Sitharaman in New Delhi on September 3, 2025, announced a major overhaul to India’s Goods…

States should get compensation for GST revenue loss; eco growth should benefit all: Kerala FM Balagopal

New Delhi: Kerala Finance Minister KN Balagopal on Sunday said GST rate rationalisation benefits should be passed on to the common people, but if there…

GST reforms are huge victory for each and every citizen of country: Nirmala Sitharaman

Chennai: Union Finance Minister Nirmala Sitharaman on Sunday said that the GST reforms are a huge victory for each and every citizen of the country….

GST rejig to ease pressure on household budgets: PwC

Household budgets across India are likely to see some relief following the recent revision in Goods and Services Tax (GST) rates, according to a report…

GST reforms not linked to Trump tariffs, clarifies Nirmala Sitharaman

Finance Minister Nirmala Sitharaman on Tuesday said the Goods and Services Tax (GST) reforms were planned well in advance and not a reaction to the…

Govt allows companies to change MRP on unsold stock as per new GST rates

Updated on: Sept 09, 2025 05:06 pm IST The revised prices must reflect GST changes only. The old MRP must remain visible, Union Minister Pralhad…

GST was long overdue, initial rollout had too many rates, says Jamshyd Godrej

Jamshyd Godrej, Managing Director of Godrej & Boyce, has said that the Goods and Services Tax (GST) was long overdue and underlined the need for…