Tag: central board of indirect taxes and

Posted in Economy

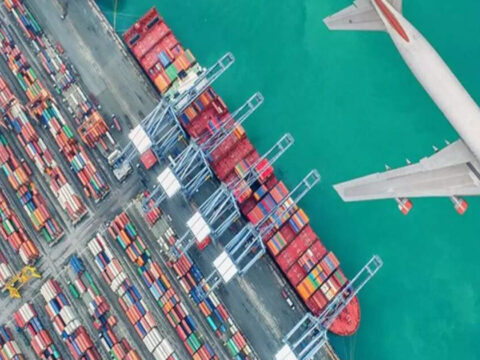

Government reviews trade risks from West Asia tensions, vows steps to keep cargo flowing

March 2, 2026 Leave a Comment on Government reviews trade risks from West Asia tensions, vows steps to keep cargo flowing

The government on Monday held inter-ministerial deliberations with exporters and logistics players to assess the impact of escalating tensions in the West Asian region on…

Posted in GST

document identification number: State GST notices must ensure Document Identification Number

August 3, 2022 Leave a Comment on document identification number: State GST notices must ensure Document Identification Number

New Delhi: The Supreme Court on Wednesday directed the Goods and Services Tax (GST) Council to issue advisories to all the states to ensure mention…

Posted in GST

Draft paper released on changes to GSTR-3B

The Central Board of Indirect Taxes and Customs (CBIC) has released a concept paper, suggesting comprehensive changes in the GSTR-3B – a self-declared summary of…