Tag: cbic

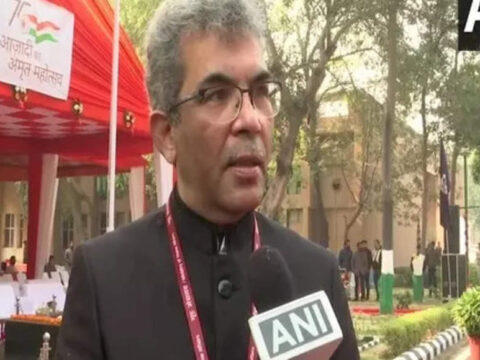

gst collection: Rs 1.5 lakh crore monthly GST collection has become the new normal: CBIC chief Vivek Johri

Vivek Johri, Chairman, Central Board of Indirect Taxes and Customs (CBIC), has said that Rs 1.5 lakh crore in goods and services tax (GST) collection…

GST: Will use property tax data, electricity bill to increase GST base: CBIC Chairman

The Central Board of Indirect Taxes and Customs (CBIC) will use the data of electric meters and property tax to increase the base of goods…

GST: From payment for not serving notice period to cheque dishonour, CBIC clears the air

With the completion of 5-years since the introduction of GST, the certainty of tax positions and ease of compliances for taxpayers have emerged as key…

document identification number: State GST notices must ensure Document Identification Number

New Delhi: The Supreme Court on Wednesday directed the Goods and Services Tax (GST) Council to issue advisories to all the states to ensure mention…

gst council: From canteen to medical insurance, GST Council provides much-awaited relief on employee perks

In the last meeting, the GST Council promised to issue clarifications relating to various Input Tax Credit (ITC) issues under GST. Keeping its promise, the…

gst news: GST 2.0 may be free of jurisdiction: Vivek Johri, chairman, CBIC

India could consider a significant shift in the Goods and Services Tax (GST) including a jurisdiction-free regime as part of the next set of reforms…

gst: Track and trace: Tech is powering GST administration and compliances

The process of digitisation picked-up momentum in 2015 with the launch of ‘Digital India’ – A flagship program by Prime Minister Narendra Modi with a…