Tag: Bank

Niti Aayog: Budget should have focused more on asset monetisation, says Former Niti Aayog Vice Chairman Rajiv Kumar

Former Niti Aayog Vice Chairman Rajiv Kumar on Thursday said the Budget should have focused more on asset monetisation and privatisation, besides allocating more funds…

inflation: How the latest inflation data spells trouble for consumers

The latest data shows an unexpected spike in inflation, but what do these numbers mean for you? How can these numbers affect your household budget,…

andhra pradesh: Andhra Pradesh bullish on investments, aims 10% share in India’s exports soon

Andhra Pradesh will soon contribute to 10% of India’s annual exports once new ports projects as well as last mile connectivity are completed, Industries &…

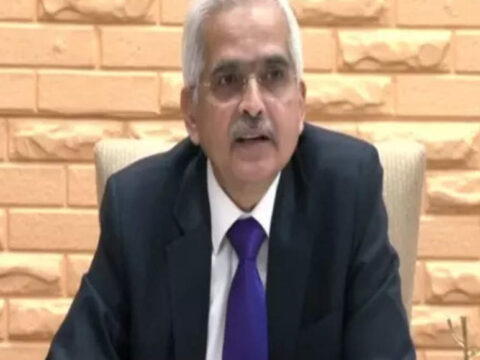

rbi: RBI wants opinion of stakeholders whenever there is policy announcement: Governor Shaktikanta Das

Reserve Bank of India‘s Governor Shaktikanta Das on Saturday said whenever a policy is taken or any announcement is made by the central bank, there…

forex reserves: India’s forex reserves drop by $1.5 billion to $575.3 billion as on February 3

India’s foreign exchange reserves fell for the first time in four weeks, dropping to $575.27 billion in the week ended February 3, Reserve Bank of…

rbi: RBI may need to continue infusing longer-term liquidity, say analysts

The Reserve Bank of India‘s move to inject longer-term liquidity through a tool it had left untouched for three years is likely to be used…

Households expect inflation to rise over a one year horizon

Despite softening of consumer inflation for two consecutive months, inflation expectation of households rose for three months ahead period as well as for the one…

Gold demand: Record gold buys: Why are central banks adding glitter to their coffers?

Central banks across the world picked up close to 1,136 tonnes of gold in 2022, up from 450 tonnes the year before and to a…

rbi rates hike: RBI to hike rates again on sticky inflation, Fed pressure- Analysts

The Reserve Bank of India is likely to raise interest rates once again in April as inflation pressures persist and the Federal Reserve continues to…

rbi penal charges: RBI to cap penal charges on loans payment missed by borrowers

The Reserve Bank of India (RBI) is set to cap the penal charges levied by the banks and non-banks related to loans payment missed by…