“LPs have become sort of sharp in their approach. They look at your performance over multiple cycles, see how your investments in aggregate have delivered, what kind of exits have happened, and what kind of IPOs have happened,” said Nithin Kaimal, partner at Bessemer Venture Partners. “They will also look at the depth and stability of the team and its longevity.”

This renewed interest is playing out in the fundraising market. Peak XV Partners, the rebranded entity that split from Silicon Valley’s marquee venture capital firm Sequoia Capital, is in the process of raising its first independent fund with a target corpus of $1.2-1.4 billion.

Similarly, Z47, formerly Matrix Partners India, is also in the market to raise its first independent fund since separating from its US parent and is targeting $300-400 million.

Elevation Capital, which has backed companies such as Paytm, Swiggy, Meesho and Urban Company, last year said it is moving beyond its core early-stage focus with a new $400 million vehicle, Elevation Holdings, aimed at taking long-term bets on companies it believes can create value in public markets.

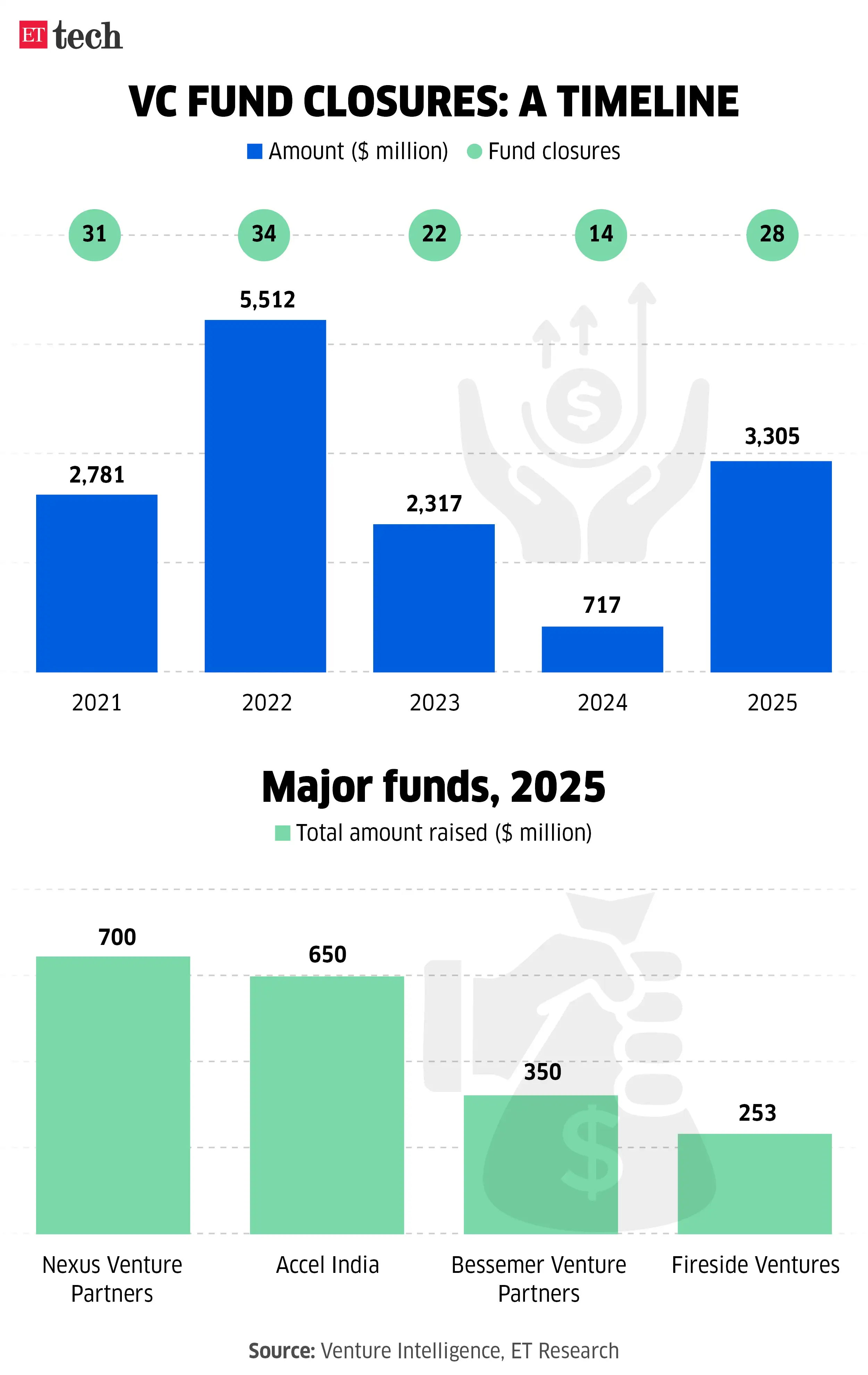

According to data from Venture Intelligence, analysed by ET, India-focused venture capital funds raised more than $3.3 billion in 2025, nearly five times the capital raised a year earlier, marking a sharp rebound in fundraising activity following a slowdown after 2021-2022 highs.

The major fund closures during the year included Nexus Venture Partners’ $700 million eighth fund, Accel India’s $650 million fund, Bessemer Venture Partners’ $350 million fund and Fireside Ventures’ $253 million sixth fund.

ETtech

ETtechExit visibility

A key driver of renewed LP confidence has been improved exit visibility, particularly through a more active initial public offering (IPO) market for new-age companies. With firms such as Zepto, PhonePe, Oyo and Boat preparing for public listings, LPs evaluating long-duration commitments are gaining comfort around capital return timelines.

According to Navin Honagudi, managing partner at Elev8 Venture Partners, which closed its maiden fund at Rs 1,400 crore last year, LP sentiment towards India has turned decisively positive as investors are seeing a full venture cycle play out. He noted that the perception that venture capital ties up money indefinitely is changing.

“Earlier, the perception was that you invest in a venture, and you don’t know when the money will come back. Thankfully, we are now seeing that cycle come through,” Honagudi said.

Beyond cyclicality

As a result, concerns around global interest rates and rupee depreciation, while still part of LP risk assessments, have taken a back seat to questions around whether fund managers can return capital across cycles, investors noted. Short-term mark-to-market volatility is increasingly viewed as manageable, as long as portfolio companies can reach scale, profitability and public market readiness.

The more selective LP environment has coincided with significant churn at large venture capital firms. Harshjith Sethi, managing director at Peak XV Partners, stepped down late last year following a series of senior departures. Earlier, Peak XV managing directors Shailesh Lakhani and Abheek Anand exited the firm in June.

Other recent VC exits include Pranay Desai, managing director at Z47, and Mohit Sadaani, a venture partner at Z47-anchored DeVC.

Data from executive search firm Longhouse Consultancy showed the venture capital industry saw nearly two dozen high-profile departures and lateral moves during 2025. The exits have raised questions about whether the experience and track records of departing general partners will translate into successful solo fundraises.

The AI drawcard

As a growing share of global venture capital is being allocated to artificial intelligence, LP interest in India is increasingly being shaped by the scale of opportunity in AI-led software, services and vertical-specific applications. Investors said the country is now being viewed not just as a consumption-driven market, but as a global hub for AI businesses serving international customers while leveraging local engineering talent and cost efficiencies.

At consumer-focused VC firm Fireside Ventures, which closed its largest fund so far in 2025, LP discussions centred on the firm’s track record and the resilience of India’s consumption story, rather than near-term macro volatility, partner Adarsh Menon said.

Fireside’s first fund has delivered a 3.5x return, with subsequent funds showing early capital return. This performance, coupled with optimism around India’s consumer market, made the fundraising process “fairly smooth,” he said.