The stock closed at Rs 167.05 on the BSE, reaching Rs 179 during the day’s session.

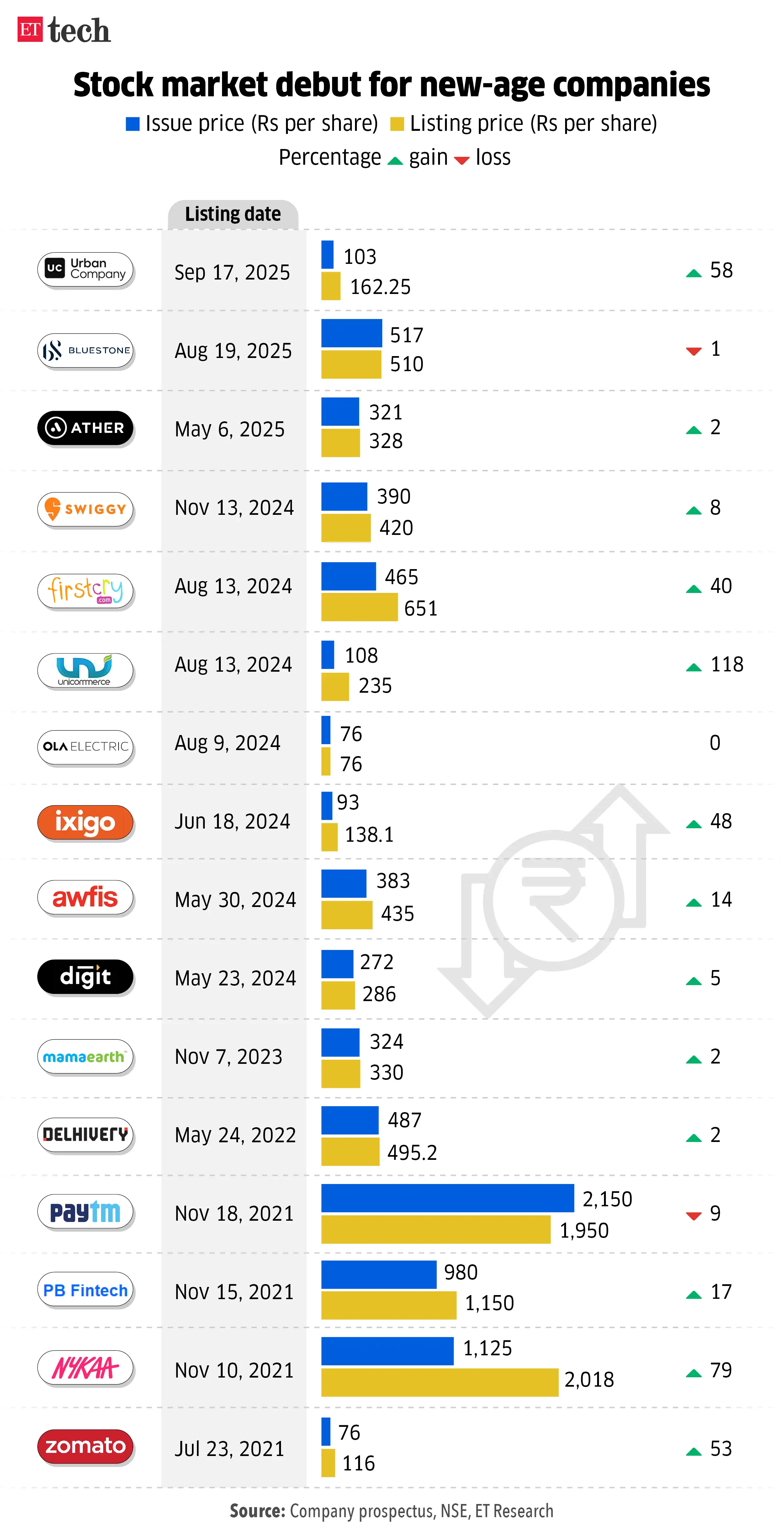

The past few years have seen significant IPOs from tech companies, such as Ather Energy, BlueStone, Swiggy, Ola Electric, FirstCry, and Awfis. Here’s a snapshot of notable new-age market debuts and Day 1 gains:

ETtech

ETtechAther Energy

Ather Energy shares had a muted debut on the Indian exchanges on May 6. The shares listed on the NSE at Rs 328 per, a premium of 2.18%. On BSE, the shares listed at Rs 326.05, a premium of 1.57%.

Since listing, the stock has risen nearly 88%. It closed at Rs 570.40 on the BSE on Wednesday.

Omnichannel jewellery retailer Bluestone saw a tepid listing in August. Its shares had opened on August 19 at a 1.5% discount to the IPO price of Rs 517 on the BSE, while the NSE opening price was Rs 510. The company’s market capitalisation at the end of the day stood at Rs 8,262.09 crore.

The stock is up about 9% since then and closed at Rs 596 on Wednesday on the BSE.

Food delivery and quick commerce giant Swiggy listed at Rs 421, an 8% premium over its issue price of Rs 390, on November 13 last year.

Swiggy’s competitor Zomato hit the bourses in July 2021 at Rs 115 on the BSE. This was a premium of 51.3% over the IPO price of Rs 76, and the stock went as high as 81% over the issue price to log a day’s high of Rs 138. It ended at Rs 125.85, up 65.6%.

Ola Electric

Bhavish Aggarwal-led EV maker Ola Electric floated its Rs 6,146-crore IPO on August 2. Disappointingly, the stock listed flat on August 9 at a price of Rs 76. However, it went on to hit the upper circuit later in the day.

The stock has since been on a rollercoaster ride. The company came under scrutiny due to rising consumer complaints, prompting the Central Consumer Protection Authority (CCPA) to issue a notice. The stock lost over 50% of its market capitalisation about two months ago, falling from a peak of over Rs 66,000 crore to just under Rs 30,000 crore. However, in the past two months, the stock has rebounded 45% and pared its losses.

It closed at Rs 58.76 on Wednesday on the BSE.

Brainbees Solutions, which operates and owns FirstCry, made its debut on the exchanges on August 13. The Rs 4,194-crore IPO saw high demand among investors, and listed at a 40% premium on the NSE on debut. The stock listed at Rs 625 on the BSE, up 34.4% over its issue price of Rs 549.

Ecommerce software firm Unicommerce Esolutions had one of the strongest debuts this year. It listed on the exchanges in August at nearly a 117% premium to its issue price. The company’s scrip listed on the NSE at Rs 235 apiece, more than double its issue price of Rs 108.

Ixigo

Le Travenues Technologies, which operates the travel platform Ixigo, had a stellar debut on Dalal Street in June with a premium of 48.5% over its issue price of Rs 93. Ixigo’s Rs 740-crore listing saw bids exceeding 98 times the shares on offer.

Coworking company Awfis’ Rs 599-crore IPO closed in May amid high demand from investors. The stock debuted at Rs 432.25 on the BSE, a premium of 12.85% to the issue price of Rs 383 per share. Year to date, the stock has been on an upward trend, registering nearly 75% growth in its share price. It closed Wednesday’s session at Rs 729.45.

Honasa Consumer, the parent of beauty and personal care brand Mamaearth, listed on the bourses in November 2023 at a slim 2% premium on the issue price. The stock opened at Rs 330 on the NSE as against the IPO price of Rs 324. On the BSE, it debuted at Rs 324.

Source link

https://www.infinitycompliance.in/product/online-company-registration-in-india/