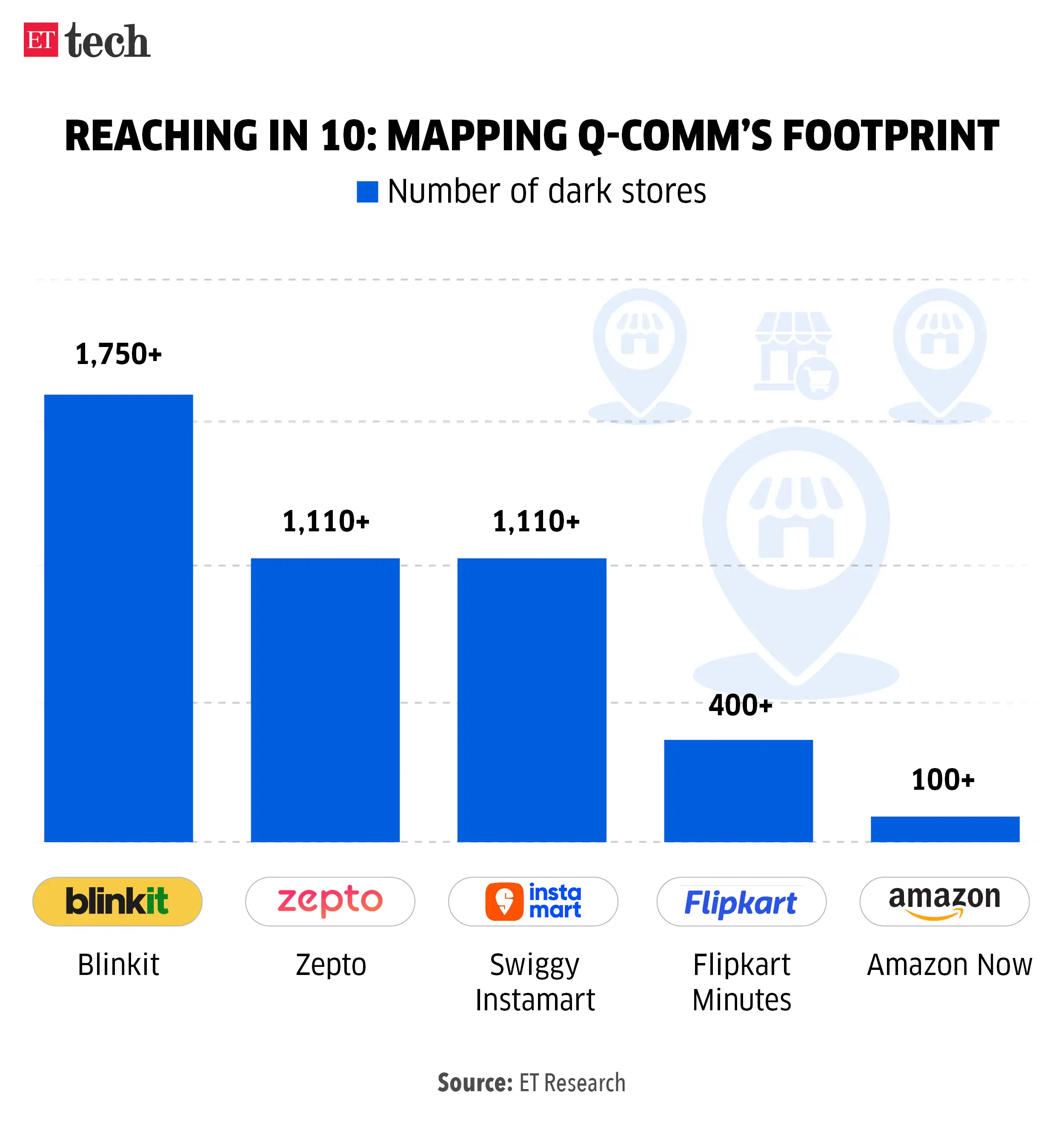

Blinkit has added 150-200 dark stores between June and September to cross 1,700 stores, while rivals Swiggy Instamart and Zepto added fewer than 100 stores each in the same period.

A report by ecommerce consultancy firm Datum Intelligence pointed out that quick commerce is expected to account for around $1.6 billion, or 12% of total online sales, during this year’s festive season.

Walmart-owned ecommerce marketplace Flipkart’s quick commerce unit Minutes has crossed 400 dark stores mark with a metro-focused push, a person aware of the issue said. Amazon Now is also widening its footprint, entering Mumbai after nearly full coverage of Bengaluru and partial coverage of Delhi-NCR, and now has 100 dark stores on its network.

“Currently operating 400 stores, we plan to double this footprint to 800 post the Big Billion Days…We are not just going deeper in metros, we are also going wider across India. As we add 600 more stores, our focus remains on delivering speed, reliability, and convenience to millions of customers, especially during high-demand periods like the festive season,” Hemant Badri, Flipkart’s senior vice president and head of supply chain. Eventually, it hopes to have 1000 stores.

ETtech

ETtech

Also Read: How dark stores are powering quick commerce’s rise

He added that Flipkart Minutes’ approach was to build hyperlocal density and predictability. In cities such as Bengaluru, Mumbai, Kolkata, and Delhi, the company already serves 85-90% of pin codes, and the goal was to achieve near complete coverage across all 19 cities before the festive season.

Swiggy’s Instamart added capacity early to handle peak demand, its CEO Amitesh Jha told ET. “In a sale, the biggest challenge any platform faces is managing the supply chain. What typically happens is there’s a sudden spike in demand. To address this, we’ve built capacities ahead of time, and we want to ensure they are utilised effectively during the sale event,” he said.

Instamart has announced it will launch its first ever festive sale event ‘Quick India Movement’ from September 19. Jha also said that when the company started conceptualising the sale event, it hadn’t factored in the impact of revision in goods and services tax (GST) rates that is expected to boost demand.

Quick commerce executives also pointed out that Blinkit has been aggressively expanding its network footprint – much faster than its peers.

“Blinkit was among the last of the major players to enter Mumbai and Bengaluru but now is the largest player in both markets in terms of its network,” the person quoted earlier said.

Also Read: Ecommerce logistics companies join quick commerce bandwagon as orders rise

Blinkit did not respond to ET’s queries.

“Our prop checks suggest Blinkit has expanded its product availability leadership in Delhi-NCR, achieved leadership in Mumbai (from fourth six months ago) and maintained top 2 position in Bengaluru. It has maintained the lowest headline discounts in this period,” as per a report by brokerage firm JP Morgan.

ET reported earlier that quick commerce platforms are also bolstering their temporary workforces by 40-60% this festive season to cope with a surge in demand.

Also Read: Blinkit, Instamart gain in quick commerce as Zepto stalls in Q1