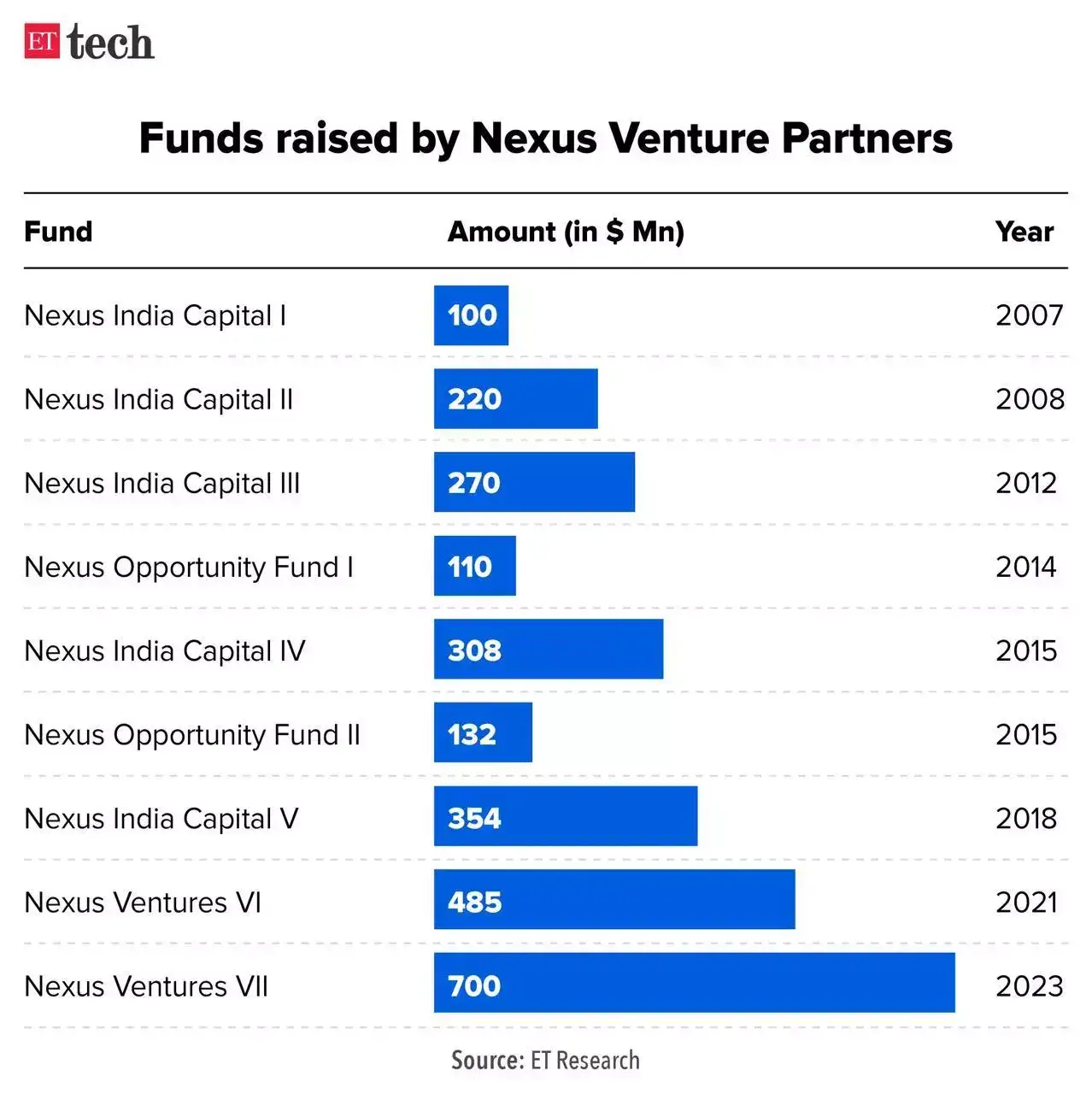

The firm had raised a similar $700 million for its previous fund in 2023.

A key shift in the new fund is Nexus’ plan to deploy capital in US-only ventures alongside its longstanding strategy of backing cross-border Indian software companies, thus broadening the geography of its ambitions.

“We understand open source, we understand developers as customers, the AI infrastructure and applications stack… We have evolved from backing India-based startups to investing in US-based ones in software/AI. So, we will play on the front foot in the US in some of the domains we understand well,” cofounder Suvir Sujan told ET.

Founded in 2006 by three Silicon Valley entrepreneurs, the late Naren Gupta, along with Sujan, and Sandeep Singhal, Nexus had emerged as one of the first Indian venture firms to invest in software startups across India and the US. Presently, the fund is led by general partners Abhishek Sharma and Jishnu Bhattacharjee in the US, and Anup Gupta and Sujan in India.

ETtech

ETtechReturns and exits

Over the past few years, Nexus has returned about $700 million through partial and full exits, including the IPO of logistics firm Delhivery, and overall, till date, it has returned $1.5-2 billion, Sujan said. The exits include the listings of logistics firm Delhivery, US adtech firm PubMatic, and the sale of software companies such as Cloud.com (acquired by Citrix), Mezi (bought by American Express), and Gluster (acquired by Red Hat).

New-age Indian firms have seen a flurry of IPOs over the past two months, with biggies like Groww and Lenskart already having been listed, and Meesho expected to be next. This has facilitated exits worth Rs 15,000 crore for investors.

“We have a strong portfolio of exceptional companies that can generate outsized returns in the next few years, including Turtlemint, Zepto, Rapido, Postman, and Apollo,” Sujan noted. Zepto, where Nexus holds about 13–14% as an early backer, is expected to file for an IPO soon.

Digital India, global software in focus

Nexus’s strategy to go all in on US AI startups comes amid a broader shift being seen across most India-focussed funds. In order to be a part of the AI gold rush, local VC firms such as Peak XV Partners, Accel, and Elevation Capital have also stationed teams in the US to participate in the fast-moving AI deal flow.

ET reported in April that Peak XV Partners (earlier Sequoia Capital India) is set to raise its first independent fund with a corpus of $1.2-1.4 billion, per people familiar with the matter. The fresh capital will be used to invest in early-stage ventures across India and the US, where it primarily wants to back AI startups.

“There is equal focus on the US and India… If a fund backs 30 companies, 15 will be in each strategy — digital India and global software / AI,” Sujan explained. He added that just a few major winners could drive exceptional returns. “If we get one to two global enterprise AI winners and one or two digital India winners, that’s enough to return multiple times the fund. Even if each (company) is in the $3–5 billion range and we own 15–20%, that’s a great outcome.’’

“We will witness a new wave of AI-native, cross-border enterprise services emerging from India, Sujan added. “Every layer of the tech stack is getting rewritten by AI. From infrastructure to applications, everything is being rebuilt. We’re doubling down on founders solving the hardest problems and shaping the next wave of global innovation.”

As for consumer tech, Sujan said the next phase will be shaped by operationally intensive businesses — like Rapido, Zepto, and Snabbit. “We are also bullish on consumer fintech and are seeing innovative opportunities in wealth, payments, and lending.”

On Snabbit, which competes with home services major Urban Company, Sujan said, “The learning was that you have to crack the bottom-of-the-pyramid service that everybody needs, which is daily house-cleaning. Snabbit is going into that.”

“If Snabbit cracks trust and predictability in daily cleaning, it can scale into adjacent categories the way Rapido did. The biggest problem is generating consistently reliable manpower supply…,” he added.