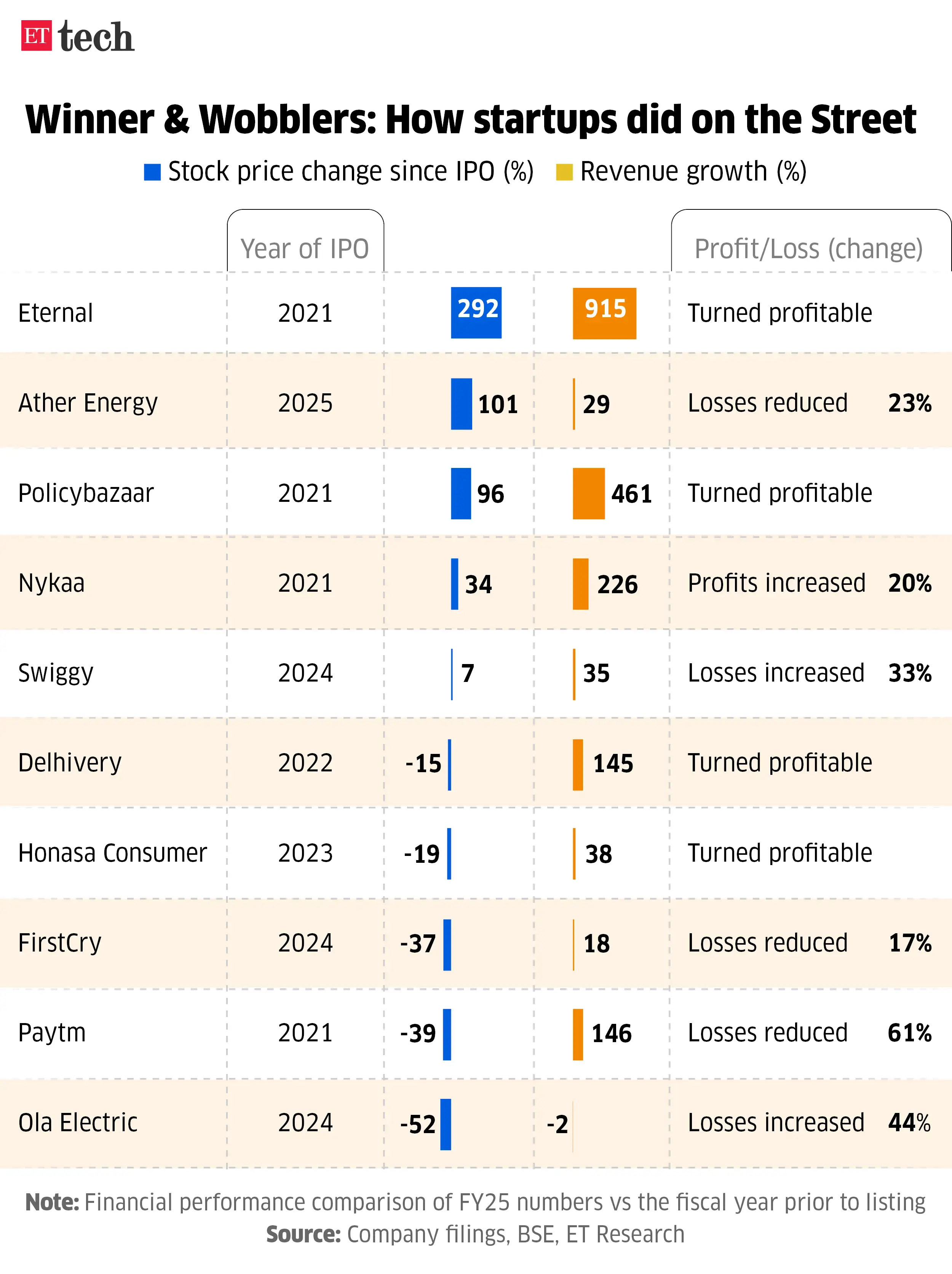

So, a host of new-age block-buster IPOs, such as those of Zomato– and Blinkit-parent Eternal, Policybazaar, Ather Energy, and Nykaa, have built on their stellar stock-market debuts through robust post-listing performances that are anchored in classical, old-economy fundamentals: Profitability.

Eternal and Policybazaar have turned profitable while Nykaa has expanded profits, underscoring that investors are prioritising earnings visibility over headline growth. Ather, though still loss-making, has managed to reduce the same meaningfully, while also gaining market share in the electric two-wheeler segment, helping support its post-listing performance.

On the other hand, several new-age companies that listed with aggressive growth plans but saw slow progress on profitability have struggled to sustain investor confidence.

ETtech

ETtechSwiggy and Ola Electric, for instance, continue to see widening losses, while Delhivery’s shift to profitability has helped stabilise sentiment around the logistics major after a turbulent post-IPO phase. Similarly, Paytm’s sharp reduction in losses and exiting its non-core businesses has aided the recovery in its financial performance as well as its stock price, which was beaten down after regulatory action in January 2024. However, it continues to trade below its IPO price.

“The market is getting far more nuanced in rewarding growth, and even more discerning about where that growth comes from,” said Kashyap Chanchani, managing director at The Rainmaker Group, a homegrown investment bank.

“Most VC-backed platforms list in the optimal IPO window… at the cusp of growth and expansion, a phase where profitability expands and valuation multiples peak. Q2FY26 reaffirmed that the real test begins post listing. Only platforms that continue to deliver predictable, compounding growth along with expanding profit command a valuation premium,” Chanchani added.

A report by The Rainmaker Group tracking the quarterly stock performance of new-age companies highlighted that platform companies are tapping into adjacent businesses post their IPOs.

“Synergy-rich, low-burn adjacencies earn re-ratings. High-burn, slow-scaling, or untested ones are met with scepticism until the business model is proven,” Chanchani noted. The report cited the examples of Eternal and Swiggy — both of which operate in the food delivery and quick commerce spaces.

When Eternal acquired Blinkit in 2022, the company’s shares nosedived with investors not being able to predict the outcome of the then-nascent quick commerce segment. But with Blinkit cementing its leadership and even showcasing operational breakeven — before entering the burn phase again —the markets are rewarding Eternal. It currently has a market cap of Rs 2.87 lakh crore.

For Swiggy, which is trading close to its November 2024 IPO price, the losses for its quick commerce unit Instamart were 3.5 times its food delivery profits in the July-September quarter. Comparatively, food delivery profits for Eternal are sufficient to cover quick commerce losses 3.5 times over. Swiggy last week concluded a Rs 10,000 crore qualified institutional placement (QIP) at a price nearly 4% lower than its IPO price.

Growth Rewards

Industry watchers also noted that public market investors factor in a company’s growth potential when assigning valuations.

Anand Daniel, partner at venture capital firm Accel, said, “The businesses that focused on tightening their economic engines, improving contribution margins, and building more predictable growth have recovered meaningfully. Others are still on that journey. Overall, the market has become far more discerning, and new-age companies are now being evaluated with the same discipline as any other sector. That’s a healthy shift.

“Five years ago, many investors were still mapping these businesses to traditional sector analogues. Today there is much deeper appreciation for platform models, network effects, cohort behaviour, and the long-term value of loyal consumers,” he added.

How market share affects stock prices can be seen in the EV two-wheeler space, where the 2024-listed Ola Electric — currently 52% down from its IPO price — has lost market share to legacy rivals like Bajaj Auto and TVS Motor, apart from Ather. Ola Electric, once the segment leader in e-scooter sales, has slipped to fifth place. Meanwhile, Ather, the third-largest player now, has also overtaken Ola in market capitalisation.

As of Friday’s stock market close, Ather’s market cap was Rs 24,623 crore — having more than doubled since its May listing — while Ola Electric’s was Rs 16,187 crore.

“The market has moved past a growth-at-any-cost mindset. Investors are no longer willing to overlook profitability slippages simply because a company is delivering 100% year-on-year growth. The speed at which a business moves towards breakeven and the level of cash burn have become critical considerations,” said Abhishek Pathak, an internet sector research analyst at Motilal Oswal Securities.

Eternal, whose stock is up about 292% from its July 2021 IPO, has clocked only 7% gains year-to-date as it stepped up cash burn to defend its leadership position in the fiercely competitive quick commerce market.

“The other thing that investors like with new-age companies is market share. If you’re an outright winner, you end up garnering a higher share of profits as well, which results in better multiples,” Pathak said.

Ultimately, valuations reflect the broader market sentiment, experts said.

“Whether markets appear picky or not depends on whether the market is in a risk-on or risk-off phase. If the market is exuberant and risk-taking, valuations will reflect that. But when money becomes scarcer and markets go through pain, they become more careful. As we learn more, we become more selective,” said Himanshu Pandya, a chartered financial analyst, and founder of HP Private Wealth Advisory Services, a Sebi-registered investment advisory firm.