Agrawal’s standout bet has been on wealthtech firm Groww, which has surged multifold in six years. He edged past industry veteran TCM Sundaram, founder of Chiratae Ventures, who has backed and exited marquee names such as Lenskart, Policybazaar and Zivame.

ETtech

ETtechWhat swayed the jury was Agrawal’s conviction in supporting Groww in 2019, when India’s stock broking market was dominated by banks and Zerodha. Peak XV Partners doubled down in subsequent rounds, helping Groww scale up to a $7 billion valuation.

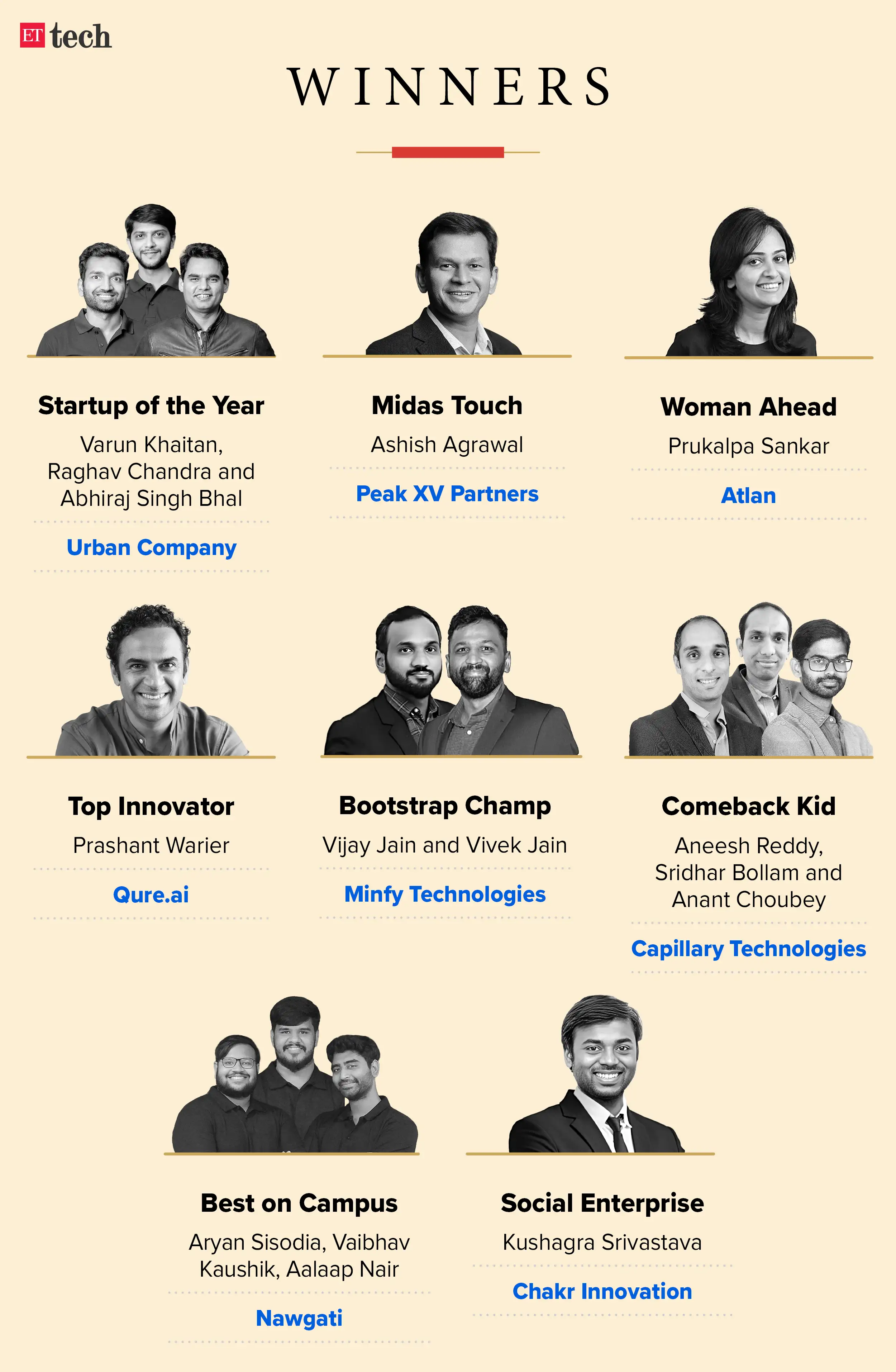

Also Read: ET Startup Awards 2025 | Urban Company brings it home, bags top honours

During its deliberations, the jury was split — making strong cases for both Agrawal and Sundaram. While one juror lauded Sundaram’s acumen for taking early and high-conviction bets on Lenskart and Policybazaar, which went on to become leaders in their respective segments, the recency of Agrawal’s investments tilted the scales in his favour.

“TCM bet on unproven models in India, which later became mega success stories… it is important to consider how early these investors were able to identify the opportunities of tomorrow,” said a member of the jury.

Agrawal, who focuses on fintech and consumer internet bets, also had two of his portfolio firms in the fray this year—Progcap cofounder Pallavi Shrivastava was nominated in Woman Ahead category, while Groww was a finalist in Startup of the Year. “I have been fortunate to partner with incredible founders and am a beneficiary of the amazing work done by them. The companies they have built have driven societal impact at scale in a relatively short time-frame. This pace of value creation is emblematic of the vibrancy and dynamism of the Indian economy. This award is a recognition of the efforts of our founders and of the entire Peak XV team,” Agrawal told ET.

Bengaluru-based Groww filed its draft red herring prospectus confidentially on May 26 and received Sebi’s nod on August 28 to list.

Agrawal was quick to spot the surge in investor interest in asset classes like equities. His bet on Groww was driven by the view that traditional assets were losing appeal and by the regulatory reforms aimed at boosting retail participation in capital markets — an early conviction that has multiplied in value over the past six years. This was primarily based on the new set of investors seeking a better user experience while investing in stock markets.

Besides Groww, Agrawal has backed 24 companies such as Pristyn Care, GoKwik and Leap Finance. An alumnus of IIT Kanpur, Agarwal started out as a campus entrepreneur, running mobility startup Yatayat, an Uber for auto-rickshaws, in Kanpur and Delhi for a little more than a year before moving to management consulting at McKinsey in 2011.

He first donned the investor hat when he joined Sequoia India as an analyst in 2013. He was promoted to managing director in 2021.

Other contenders in this year’s Midas Touch list included Pranav Pai of 3one4 Capital and Shailesh Lakhani, who recently quit Peak XV Partners.

Other contenders

Pranav Pai

Company Images

Company ImagesPranav Pai

Shailesh Lakhani

Company Images

Company ImagesShailesh Lakhani

TCM Sundaram

Company Images

Company ImagesTCM Sundaram

Source link

https://www.infinitycompliance.in/product/online-company-registration-in-india/