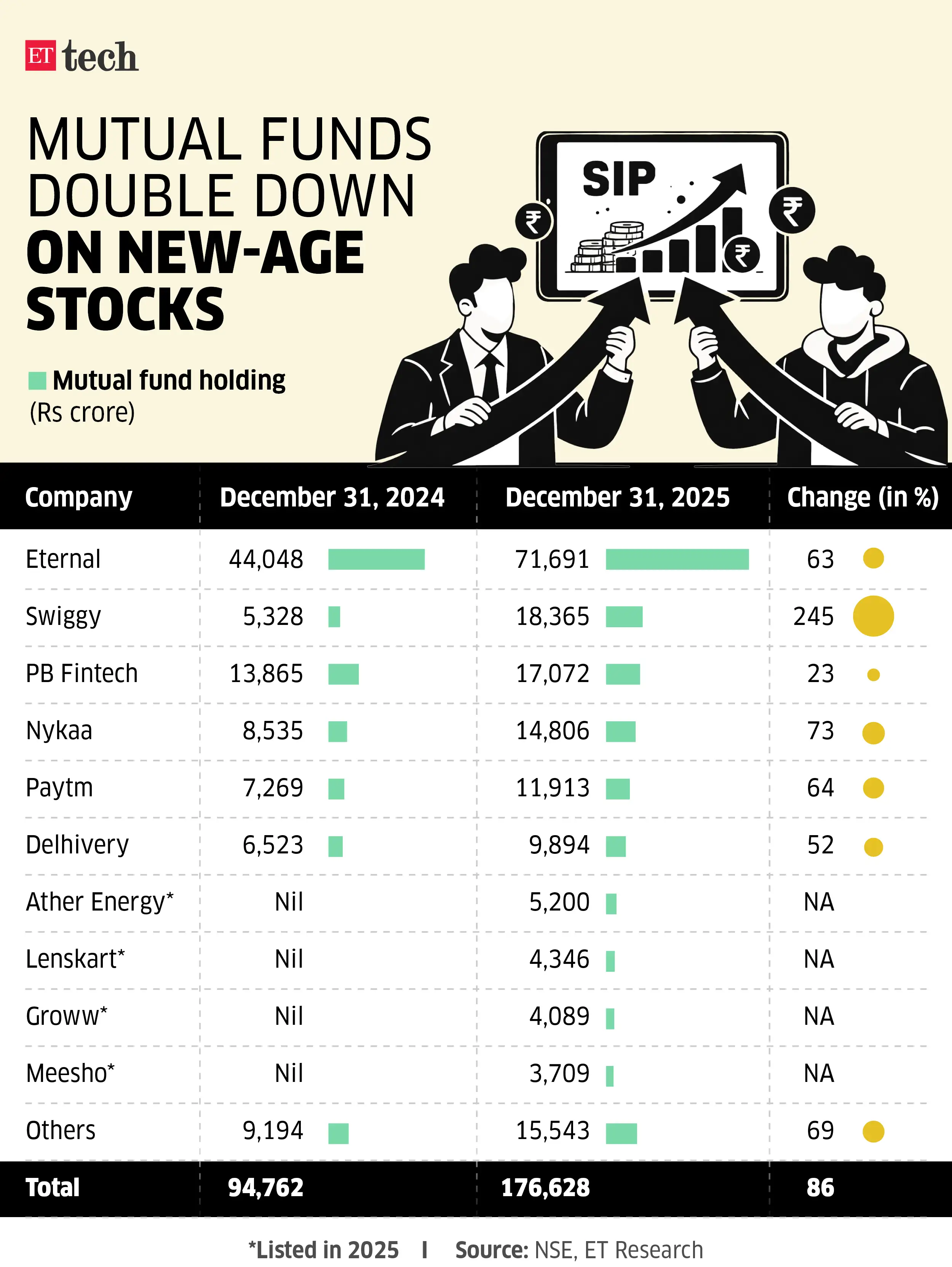

These institutions accumulated significant stakes in consumer internet firms Eternal, Swiggy, Nykaa and PB Fintech this past year, despite mixed share performance. They also bought into companies such as Lenskart, Groww, Meesho and PhysicsWallah, that entered the public market in 2025.

Mutual funds were major buyers in Swiggy’s Rs 10,000-crore share sale to institutions in December, and their holding in the food delivery and quick commerce firm more than tripled in 2025.

ETtech

ETtechBig chunk with Eternal

Their stake in rival Eternal, too, rose sharply, even as the share price of the Zomato and Blinkit parent ended flat in 2025, after wide fluctuations during the year. Eternal, part of the Nifty 50, accounted for more than 40% of total mutual fund holdings in new-age companies.

On a like-for-like basis, or excluding companies that listed in 2025, the holding of funds such as ICICI Prudential, Axis, Aditya Birla, Motilal Oswal, Kotak, HDFC, Nippon, Invesco India and Mirae Asset rose more than 60% to Rs 1.53 lakh crore.

“Future growth lies in the digital space, which means that it (the digital space) will become bigger over time at an accelerated pace,” said Varun Sharma, executive group vice-president at Motilal Oswal Asset Management Company, indicating why the fund houses are accumulating stakes in these companies. “This space is growing anywhere between two-and-a-half and three times the rate of nominal GDP growth.”

These companies will grow much larger than their traditional counterparts in the same sectors over the next 10 years, he said. “That’s how it played out in the US as well, where tech companies are bigger than the traditional companies in the same space.”

Other side of the trade

While sharp gains in the price of stocks such as Nykaa, Paytm and Ixigo contributed in part to the total value growth, fund houses also boosted ownership in new-age companies where share prices fell.

For instance, their exposure to Ola Electric increased, despite the electric two-wheeler company posting losses and losing market share to rival Ather Energy, and several other institutional investors reducing or exiting their positions in the stock.

As of December 31 last year, mutual funds held a 5.54% stake in Ola Electric worth Rs 886 crore, compared with 4.09%, or Rs 1,545 crore, a year earlier, with the lower value reflecting a 58% decline in the Bengaluru-based company’s stock price.

In FirstCry, mutual funds increased their holding to 14.36% against 9.02%, but the value of the holding fell 30% amid a 56% drop in its stock price.

“Mutual funds have adopted a contrarian stance on select names, backing the long-term growth of the underlying categories at current valuations. While near-term pressures remain in some cases, the longer-term investment thesis is largely unchanged,” said a Mumbai-based analyst at a global brokerage firm.

IPO drive

The ownership of domestic institutions, including by mutual funds, is only expected to rise, particularly with several more new-age companies readying to go public, analysts and industry executives said.

ET reported in January that new-age companies including Zepto, Oyo, PhonePe and Infra.Market were looking to access public markets capital totalling about Rs 50,000 crore. Mutual fund interest is often a key contributor to the success of public offerings.

Foreign investors pay close attention to Indian mutual funds when anchor allocations are being made, said the founder of a new-age company preparing to list next year. “If domestic funds show up in size, it changes the tone of the room,” he said.

The same dynamic also plays out in pre-IPO roadshows, where getting mutual funds on board becomes critical to how well an issue ultimately lands, he added.

What remains consistent, though, is the view to take larger bets on segment leaders.

“From a near-term perspective, what is important is to back the leader in every sub-segment, simply because digital as a domain tends to be a ‘winner takes all’ market, where the leader almost captures over 100% of the profits of the sub-segment,” said Motilal Oswal’s Sharma. “This means that if you’re invested in the leader in a sub-segment that is expected to grow at a high pace, the longer-term profitability of the business or that space is intact.”