GST News: GST’s half-a-decade journey: Tech usage to plug revenue leaks, Rs 1.3 lakh cr monthly tax ‘new normal’

India’s biggest tax reform, the Goods and Services Tax (GST), completes its half-a-decade journey on June 30, with many hits and some misses, and also…

GST News: 5 years of GST: A mix of success and work in progress

‘One nation, One market, One tax’ – the driving motto behind the introduction of GST, with effect from 01 July 2017, has brought 1.3mn taxpayers…

GST India: Five years of GST – Baby out of the cradle

As the Goods & Services Tax legislation completes 5 years and has evolved from its “infant” stage into a stable state legislation today, the industry…

GST registration exemption for online seller with low turnover to boost e-commerce

The government’s decision to exempt suppliers on e-commerce having less than Rs 40 lakh turnover will boost online sales of goods, industry players said on…

GST Compensation: No decision on extending GST compensation to states

The GST Council deferred the decision on levying a 28% tax on casinos, online gaming, horse racing and lottery pending more consultations with stakeholders. Further,…

GST Council Meeting Update: GST council gives relief to transport sector, small online businesses

The transportation of goods is likely to be cheaper as the Goods and Services Tax (GST) council on Wednesday gave some relief to the transport…

GST Council Meeting Today: GST council meeting to decide on Online gaming compensation today

The Goods and Services Tax (Council) is going to meet again on Wednesday to discuss crucial issues of GST compensation to states beyond June 2022…

Crypto GST: Will the levy of GST be the last nail in the coffin for cryptocurrencies in India?

The regulatory journey of cryptocurrencies (cryptos) in India has witnessed several ups and downs, drawing parallel to the steep highs and lows of the price…

GST News: GST exemptions on some items set to be removed

Packaged curd, lassi, buttermilk, foodgrains, cereals, honey, papad and a host of unbranded food items besides hotel rooms with a tariff below ₹1,000 per night…

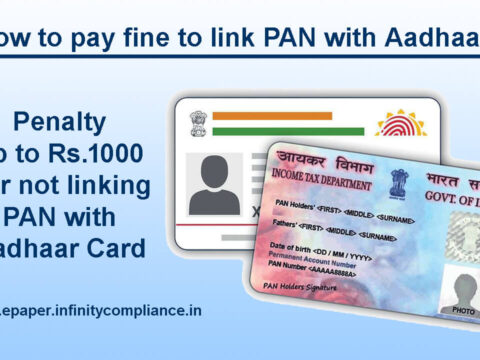

How to pay fine to link PAN with Aadhaar – PAN Aadhaar Linking

Despite the very fact that the deadline to have your PAN active without linking it to your Aadhaar has been extended to March 31, 2023, linking your PAN to…