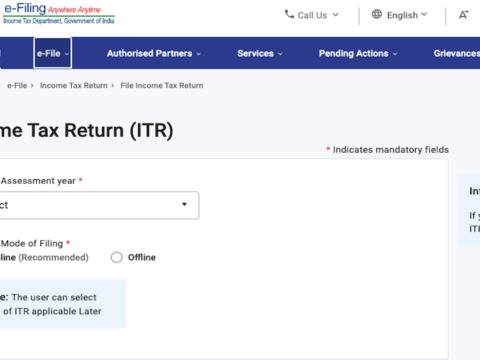

“Extend Due Date Immediately” Income Tax Return Deadline Trends

As the deadline for filing income tax returns approaches, taxpayers have asked the government to extend the deadline. The deadline for filing an income tax…

gst council: From canteen to medical insurance, GST Council provides much-awaited relief on employee perks

In the last meeting, the GST Council promised to issue clarifications relating to various Input Tax Credit (ITC) issues under GST. Keeping its promise, the…

GST exemptions: States backed removal of GST exemptions: Revenue Secretary Tarun Bajaj

The states had completely backed removing exemptions on many packaged food items, Revenue Secretary Tarun Bajaj said, explaining the case for the levy. He said…

GST Rate Revised: List of goods that will increase in price

Consumers may have to fork over more money starting on July 18 as a result of the GST Council’s approval of a rate increase to…

Shri Pramod Rao takes charge as Executive Director, SEBI

Pramod Rao has assumed leadership as the executive director of capital markets regulator SEBI, it was announced on Tuesday. According to a statement from the…

Nirmala Sitharaman’s recent statement on India’s ban on cryptocurrency: Accordant to the FM, RBI wants to restrict cryptocurrency

The Reserve Bank of India is in favour of outlawing cryptocurrencies in India, but Finance Minister Nirmala Sitharaman argues that for the law to be…

GST rate: Revised GST rates kick-in today; Here is a list of items that’ll get costlier

Consumers may have to shell out more starting July 18 as several goods and services will cost higher with the Goods and Services Tax (GST)…

tax law: How uniformity in tax law made a common national market

One of the major positives of the GST roll-out is the consolidation of over a dozen indirect taxes into a single tax. Also, unlike the…

After wheat, India now limits the export of wheat flour and associated goods

The export of wheat flour and other associated goods including maida, rava (samolina), wholemeal atta, and resulting atta has been limited by the government. Before…

Draft paper released on changes to GSTR-3B

The Central Board of Indirect Taxes and Customs (CBIC) has released a concept paper, suggesting comprehensive changes in the GSTR-3B – a self-declared summary of…