document identification number: State GST notices must ensure Document Identification Number

New Delhi: The Supreme Court on Wednesday directed the Goods and Services Tax (GST) Council to issue advisories to all the states to ensure mention…

e-Invoice GST: E-invoice mandatory for turnover above 10 crore from October 2

The centre has made E-invoicing mandatory for businesses with aggregate turnover exceeding Rs 10 crore from October 1, a move which will further plug in…

GST Slab: GoM weighs scrapping 12% GST slab

A group of ministers, mandated to look at rate rationalisation by the Goods and Services Tax Council, is mulling doing away with the 12% slab…

GST News: To tax at 18% or 28%? The GST Conundrum for skill gaming sector

In August 2022 the Group of Ministers (GoM) will suggest a GST regime for lottery, casino, and gaming businesses. In this article, we discuss the…

Consequences of Missing July 31 Deadline For ITR Filing

Consequences of Missing July 31 Deadline For ITR Filing In New Delhi: For the fiscal year 2021–2022 or assessment year 2022–2023, income tax returns (ITRs)…

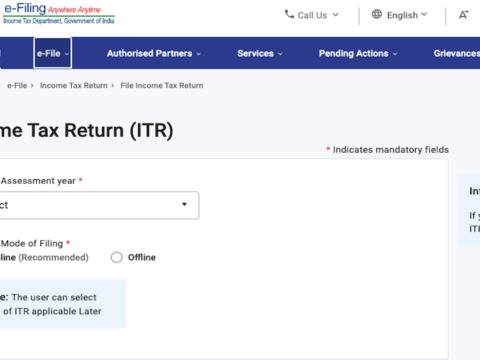

“Extend Due Date Immediately” Income Tax Return Deadline Trends

As the deadline for filing income tax returns approaches, taxpayers have asked the government to extend the deadline. The deadline for filing an income tax…

gst council: From canteen to medical insurance, GST Council provides much-awaited relief on employee perks

In the last meeting, the GST Council promised to issue clarifications relating to various Input Tax Credit (ITC) issues under GST. Keeping its promise, the…

GST exemptions: States backed removal of GST exemptions: Revenue Secretary Tarun Bajaj

The states had completely backed removing exemptions on many packaged food items, Revenue Secretary Tarun Bajaj said, explaining the case for the levy. He said…

GST Rate Revised: List of goods that will increase in price

Consumers may have to fork over more money starting on July 18 as a result of the GST Council’s approval of a rate increase to…

Shri Pramod Rao takes charge as Executive Director, SEBI

Pramod Rao has assumed leadership as the executive director of capital markets regulator SEBI, it was announced on Tuesday. According to a statement from the…