As the deadline for filing income tax returns approaches, taxpayers have asked the government to extend the deadline.

The deadline for filing an income tax return is July 31, just four days away.

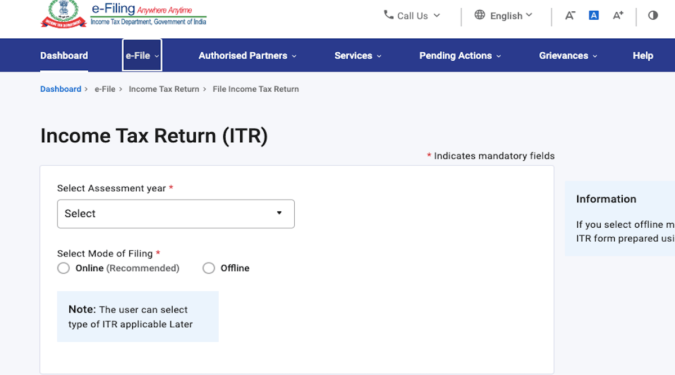

Many users have reported technical issues with the e-filing website. However, the centre has stated unequivocally that there are no plans to extend the ITR filing deadlines this year.

Union Revenue Secretary Tarun Bajaj has made it absolutely clear that the government has no plans to extend the deadline. “As of now, there is no intention of extending the deadline for filing,” Mr Bajaj was quoted as saying.

He continued, “We had over 50 lakh people last time (filing returns on the last date). This time, I’ve told my staff to brace themselves for 1 crore (returns filed on the last day).”

The statement comes just days after the All India Federation of Tax Practitioners (AIFTPs), an association of advocates, chartered accountants, and tax practitioners, requested an extension from the Ministry of Finance and the Central Board of Direct Taxes (CBDT).

In the midst of requests for a deadline extension, the apex body of CAs, the Institute of Chartered Accountants of India (ICAI), has announced that it will not make a representation to the Finance Ministry for a deadline extension.

On Monday, the ICAI asked its members not to be pressured into filing ITRs, emphasizing that it is “not in favour of making any representation for extension of any due date.”

According to government data, over 2.8 crore ITRs have been filed as of July 20.

With only four days until the deadline, the hashtag “#Extend Due Date Immediately” was trending on Twitter, with widespread requests for an immediate extension.

Income Tax Return Filing in just 1 day, click below services to connect with us.

1 thought on ““Extend Due Date Immediately” Income Tax Return Deadline Trends”