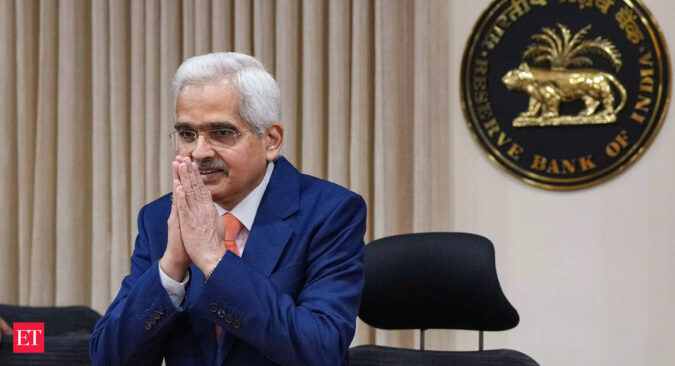

Das will address the directors — both whole time and independent — on issues related to governance, ethics, and the role of the boards in assurance functionalities of the banks, besides highlighting the supervisory expectations, sources said.

Besides the governor, the RBI communication sent to all public sector banks said, deputy governors, executive directors from its Department of Regulation as well as Supervision will be attending the meeting.

The one-day event is designed to be an interactive one where directors, including the bank chairman, and nominee directors both from the central bank and the government, will be invited to interact with the entire RBI top brass.

The government on the recommendation of the Reserve Bank introduced many reforms in governance and provided more autonomy to the board of public sector banks in recent times.

The reforms also include an independent professional body for selection, objective and transparent selection and allotment on the basis of merit-cum-performance.

For the appointment of whole-time directors in public sector banks and financial institutions, the government in 2016 set up Banks Board Bureau (BBB), which was transformed into Financial Services Institutions Bureau (FSIB) last year. Guidelines for the selection of general managers and directors of public sector general insurance companies have been made part of FSIB.

Besides, the government approved the proposal to separate the posts of Chairman and Managing Directors in Public Sector Banks (PSBs) in 2015.

While the Chairman is non-executive, Managing Director and Chief Executive Officer (MD&CEO) is the executive head.

The splitting of the posts of Chairman and Managing Director is in accordance with international best practices.

While the Chairman gives overall policy directions, MD and CEO are responsible for the day-to-day management of the bank.