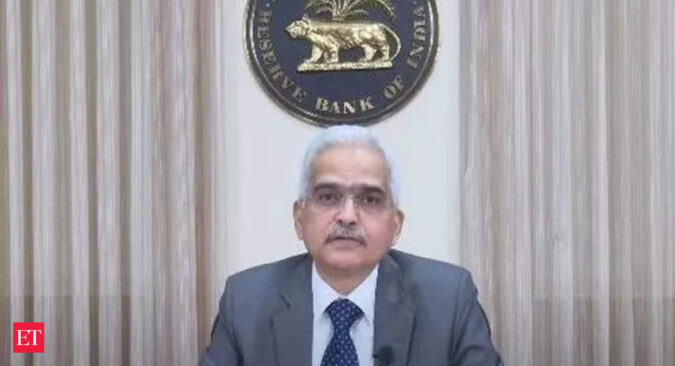

The MPC since May 2022 hiked rates by 250 bps and has paused since April. On Thursday, RBI Governor Shaktikanta Das announced that the Monetary Policy Committee (MPC) unanimously decided to keep the rate unchanged at 6.5 per cent.

While keeping the interest rate intact, Das noted that headline inflation in India still remains above the central bank’s target of 4 per cent and is expected to remain so during the rest of the year.

Five out of the six members voted to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth, with Jayanth Varma expressing reservation on the stance.

Remaining vary of the future trajectory of inflation, Das noted that the pace of monetary tightening has slowed in recent months, but uncertainty remains as inflation continues to rule above targets across the world.

Despite hitting an 18-month low of 4.70% in April, analysts do not expect India’s inflation to fall to the RBI’s 4% medium-term target for at least another two years.”Our goal is to achieve the inflation target of 4% and keeping inflation within the comfort band of 2-6% is not enough,” Das said.”This was a ‘Goldilocks’ pause for the RBI. In the run-up to the policy meeting, the economy finds itself in a fortuitous ‘Goldilocks’ macro situation, with better-than-expected Q4 FY23 GDP growth and inflation tracking closer to the RBI’s mid-point target of 4%. Our macro view though remains that both, growth and inflation is likely to undershoot the RBI’s projections in FY24,” said Aurodeep Nandi, India Economist and Vice President at Nomura.

Here is a quick look at all the key decisions and views:

- Repo rate unchanged at 6.5 per cent

- The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent

- Domestic economic activity remains resilient in Q1FY24 as reflected in high-frequency indicators

- Inflation forecast: CPI inflation is projected at 5.1 per cent for FY24. Q1, Q2, Q3 and Q4 forecast at 4.6 per cent, 5.2 per cent, 5.4 per cent and 5.2 per cent respectively

- Headline inflation is projected to decline in FY24 from FY23 levels but would still be above the target. The progress of the southwest monsoon remains critical in this regard

- The monsoon forecast by IMD augurs well for Kharif crops but the distribution of monsoon needs to be monitored. Crude oil prices have eased, but the outlook is uncertain

- Real GDP forecast: GDP growth for FY24 is 6.5 per cent. Q1, Q2, Q3 and Q4 at 8.0 per cent, 6.5 per cent, 6.0 per cent, and 5.7 per cent respectively

- Real GDP growth in 2022-23, on the other hand, turned out to be stronger than anticipated and is holding up well

- The policy repo rate has been increased by 250 basis points since May 2022 and is still working its way through the system. Its fuller effects will be seen in the coming months

- The average system liquidity, however, is still in surplus mode and could increase as ₹2,000 banknotes get deposited in the banks

“While economic momentum remains resilient, there are significant risks. We expect MPC to remain on an extended pause. System liquidity is the one parameter which will need monitoring,” said Saugata Bhattacharya, Chief Economist, Axis Bank.

RBI Governor Das said that RuPay Prepaid Forex cards will be issued by banks in India for use at ATMs, PoS machines and online merchants overseas. RuPay Debit, Credit, and Prepaid Cards will be enabled for issuance in foreign jurisdictions, which can be used internationally, including in India.

RBI has proposed the expansion of the scope of e-RUPI vouchers by permitting non-bank PPI issuers to issue them. It has also been proposed to enable the issuance of e-RUPI vouchers on behalf of individuals.

The central bank proposed that all SCBs, ex-small finance banks, be able to set their own limits for borrowing in Call and Notice Money Markets within RBI’s prudential limits for inter-bank liabilities.

With a focus on streamlining and harmonising the resolution of stressed assets, certain norms will be announced by the RBI. Further, a regulatory framework is to be put in place permitting Default Loss Guarantee arrangements in Digital Lending.

Phase-in time for achievement of priority sector lending targets for UCBs has been extended by two years. UCBs that met targets as on March 31, 2023 will get suitable incentives.

The process flow of transactions and membership criteria for onboarding operating units in Bharat Bill Payment Systems (BBPS) will be streamlined to enhance the efficiency of the system and encourage greater participation.