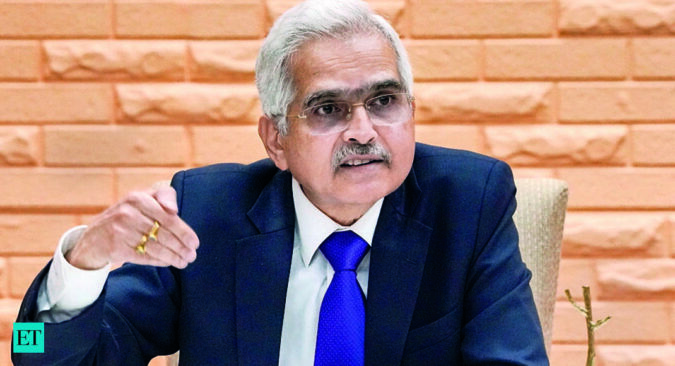

“At times, some PSOs display unwillingness to comply with regulatory instructions, citing various reasons like cost of carrying out system-level changes,” Das said at a payment system operators conference in Kochi on Saturday.

In this digital age, when payment system operations are heavily dependent on technology and many new-age tech firms are entering the payments ecosystem, it is necessary to constantly upgrade the systems to remain relevant and increase efficiency, he said.

Increase in digital payments has also brought to the fore potential risks pertaining to cyber security, data privacy and operational resilience, the RBI governor said. “PSOs must always be cognisant of the emerging threats and put in place suitable risk mitigation measures,” he said.

Outsourcing arrangements of payment operators with their vendors need special attention and these agreements should meet minimum standards prescribed by the Reserve Bank, he said.

Payment system operators should work on formation of self-regulatory organisations (SROs) for greater good of all stakeholders.

The RBI governor also stressed that the payments landscape in India has evolved into a state-of-the-art system that is affordable, accessible, convenient, fast, safe, and secure. About 10.50 billion retail digital payment transactions worth ₹51 lakh crore were processed in January 2023, and that stands as a testimony to the size and efficiency of India’s digital payments, he said. Launched in 2016, the country’s flagship payments platform – Unified Payments Interface (UPI) – has revolutionised the payments ecosystem with about 8.03 billion transactions worth ₹13 lakh crore processed in January 2023 alone.

This has helped Digital Payments Index (DPI) – developed by the central bank to gauge the adoption of digital payments in the country – go up from 100 as the base in March 2018 to 377.46 as of September 2022, in a testimony to the long way the country has travelled, Das said.

He also said payment companies should make available an expeditious grievance redress mechanism to ensure public trust in digital payments. “More the struggle undertaken by people in resolving their grievances, more unlikely it becomes that they would attempt digital payments in future,” Das said.