At the core of the Budget was the vision of Viksit Bharat — anchored in eliminating poverty, ensuring quality education for all, providing affordable healthcare and creating full employment through skills.

It also sought to increase women’s participation in the economy and position farmers as key contributors to global food security. The budget set these priorities to shape spending choices and reform plans in the year that was to follow.

The Budget aimed to sustain growth momentum, draw in private investment and improve households’ confidence in the economy. Strengthening purchasing power, particularly among the middle class, was projected as a key objective.

Development efforts focused on four groups: the poor, youth, farmers and women. Policies were sought to be designed to make development spread to different sectors and regions.

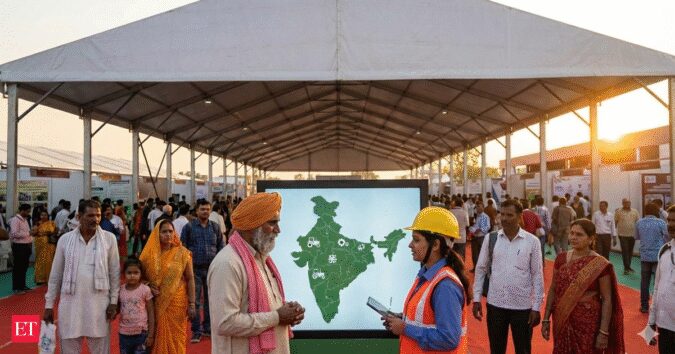

To deliver on this agenda, the government identified four growth engines: agriculture, MSMEs, investment and exports. Structural reforms were presented as the fuel powering these engines.

Budget 2025: Agriculture, the first engine

Agriculture received renewed attention through the Prime Minister Dhan-Dhaanya Krishi Yojana, with an aim to implement the programme in 100 districts in partnership with states.

The main focus was sought to be placed on raising productivity, encouraging crop diversification and improving irrigation. It also targeted better post-harvest storage and easier access to credit.

Alongside this, to address under-employment, a broader Rural Prosperity and Resilience programme was proposed. The idea was to connect skills, investment and technology with rural livelihoods.

The initiative aimed to prioritise women, youth, small farmers and landless families, with the objective of expanding income opportunities beyond traditional farming.

A six-year Mission for Aatmanirbharta in Pulses was also announced, with primary focus on tur, urad and masoor. It was announced that Central agencies would procure these pulses for four years based on farmer supply — a measure intended to provide price stability and market assurance.

The Budget further outlined missions for vegetables, fruits, high-yielding seeds and cotton. These steps would be designed to lift output and farm incomes, the FM said.

Loan limits under Kisan Credit Cards were proposed to be increased from Rs 3 lakh to Rs 5 lakh to expand access to affordable agricultural credit.

MSMEs as the second engine

MSMEs were marked out as critical to exports, accounting for 45 per cent of the total. The Budget focuses on helping them scale up and become more competitive. Sitharaman announced that Investment and turnover limits for MSME classification would rise significantly, allowing these entities to grow without losing policy benefits.

With the objective of reducing financing barriers, credit availability was sought to be improved through expanded guarantee coverage.

A new support scheme was announced for five lakh first-time entrepreneurs from women, SC and ST communities. The scheme featured the provion of term loans of up to Rs 2 crore over five years.

Under the broader Make in India policy, Budget 2025 also touched upon a plan to make India a global hub for toy manufacturing.

A National Manufacturing Mission was announced covering small, medium and large industries. The idea was to reinforce the push for domestic production across sectors.

India Budget Flashback: Blast From The Past

Investment as the third engine

Investment was sought to be structured around three areas: people, the economy and innovation — with targeted support for each of these areas.

Under investment in people, 50,000 Atal Tinkering Labs were proposed for government schools over five years with the aim to nurture early innovation.

Broadband connectivity was proposed to be extended to all government secondary schools and rural health centres through BharatNet.

In a move to support school and higher education, the FM announced that a Bharatiya Bhasha Pustak Scheme would provide digital textbooks in Indian languages.

Seeking to align Indian workers’ skills with modern manufacturing needs, five National Centres of Excellence for skilling were proposed to be established with global partners.

Budget 2025 also proposed to set up a Centre of Excellence in Artificial Intelligence for education with an outlay of Rs 500 crore. It would focus on digital learning tools, it was announced.

Issuance of identity cards and registration on e-Shram portal were proposed for gig workers. It also sought to give these workers ihealthcare coverage under PM Jan Arogya Yojana.

To attract private participation, infrastructure ministries would prepare three-year project pipelines under the PPP model for investment in the economy, the FM announced.

The other key proposal under this head were:

— States will receive Rs 1.5 lakh crore in 50-year interest-free loans for capital expenditure. Reform-linked incentives will be part of this support.

— A second Asset Monetisation Plan for 2025–30 seeks to raise Rs 10 lakh crore. The proceeds will fund new infrastructure projects.

— The Jal Jeevan Mission has been extended until 2028. The focus will move towards quality infrastructure and maintenance through community participation.

— An Urban Challenge Fund of Rs 1 lakh crore will support cities as growth hubs. It will also finance redevelopment and water initiatives.

— Under investment in innovation, Rs 20,000 crore has been allocated for private-led research and development. The aim is to speed up technology adoption.

— A National Geospatial Mission will build foundational data for planning. It will support urban development and infrastructure projects.

— The Gyan Bharatam Mission will survey and document over one crore manuscripts. A digital repository will enable wider access to Indian knowledge systems.

Budget 2025: Exports as the fourth engine

In Budget 2025, exports were sought to be positioned as a coordinated effort across ministries. An Export Promotion Mission was proposed with a view to helping MSMEs enter global markets.

A digital platform, BharatTradeNet, was proposed for integrating trade documentation and financing, with the aim to reduce delays and transaction costs.

Support was announced for domestic manufacturing linked to global supply chains. A plan was envisaged to help electronics manufacturers benefit from Industry 4.0 opportunities.

A national framework was proposed for promoting Global Capability Centres in tier-two cities, with the objective of spreading export-driven services growth.

Air cargo infrastructure and warehousing were sought to be upgraded, with a special focus on handling perishable produce.

India Budget: Reforms as the fuel

Budget 2025 underscored continuity in tax reforms. Measures such as faceless assessment and self-assessment were reiterated. Signalling an emphasis on lower compliance friction, the FM announced that the tax department would double down on its “trust first, scrutinise later” approach.

Here are the other key announcements on proposed financial sector and regulatory reforms:

— Improving ease of doing business remains central. Compliance requirements will be simplified and outdated provisions removed.

— The FDI limit in insurance will rise from 74 to 100 per cent. This applies to firms that invest the full premium within India.

— A light-touch regulatory framework based on trust is proposed. The goal is flexibility and productivity.

— A High-Level Committee will review non-financial regulations. It is expected to submit recommendations within a year.

— An Investment Friendliness Index of States will be launched during the year. It aims to strengthen competitive federalism.

— A mechanism under the FSDC will assess financial regulations. It will improve responsiveness to sector needs.

— Jan Vishwas Bill 2.0 will decriminalise more than 100 legal provisions. This reduces the fear of minor violations.

Budget 2025 fiscal overview

In her budget speech, the FM reiterated the govt’s commitment to fiscal consolidation, stressing that public debt was expected to stay on a declining path relative to GDP.

The revised fiscal deficit for 2024–25 came in at 4.8 per cent of GDP, and for 2025–26, it was estimated at 4.4 per cent. Total receipts excluding borrowings in 2024–25 were Rs 31.47 lakh crore, with net tax receipts at Rs 25.57 lakh crore.

Total expenditure in 2024–25 was Rs 47.16 lakh crore, with capital spending at about Rs 10.18 lakh crore. For 2025–26, receipts excluding borrowings were estimated at Rs 34.96 lakh crore. Total expenditure was pegged at Rs 50.65 lakh crore.

Direct tax changes and middle class relief

Budget 2025 reshaped income tax under the new regime. The key announcements were:

— Incomes up to Rs 12 lakh will attract no tax.

— Salaried individuals earning up to Rs 12.75 lakh will also pay no tax due to the standard deduction. The revenue impact is estimated at Rs 1 lakh crore.

— TDS and TCS provisions to be rationalised. The interest deduction limit for senior citizens doubles to Rs 1 lakh.

— The TDS threshold on rent increases to Rs 6 lakh annually. TCS collection will apply only above Rs 10 lakh.

— Delays in TCS payments to be decriminalised; the window to file updated returns to be extended to four years.

— Small charitable trusts to get longer registration periods. Taxpayers can now treat two self-occupied homes as having nil annual value.

— Customs duty changes to support manufacturing and healthcare. Several life-saving drugs to be fully exempted.

— Critical minerals and battery inputs to get duty relief. Export-oriented sectors such as leather and fisheries to also benefit.