The rate increase cycle was paused in April after six consecutive rate hikes aggregating to 250 basis points since May 2022.

This pause will help growth to become strong with the support of enhanced consumption demand in the economy, said Saket Dalmia, President, PHD Chamber of Commerce and Industry.

President of industry body Ficci Subhrakant Panda said a status quo in policy rates was largely expected and, by keeping the repo rate unchanged and maintaining the stance of withdrawal of accommodation, RBI is keeping a watchful eye on inflation while supporting growth.

“Ficci expects the impact of monetary policy interventions till date to pave the way for reversal of the rate hike cycle in due course,” he said.

Secretary General of another leading industry body Assocham said that while the Monetary Policy Committee remains focussed on withdrawal of accommodation to further rein in inflation, “we are confident that the RBI would ensure that adequate liquidity is maintained in the banking system and credit growth remains robust”. Assocham also hailed several measures like allowing issuance of prepaid RuPay forex cards for international travellers, simplifying guidelines under FEMA for authorised persons in the forex market and streamlining Bharat Bill Payment System. Since May 2022, RBI had hiked the short-term lending rate (repo) cumulatively by 250 basis points to check inflation, before hitting the pause button in April.

Commenting on the RBI’s policy review, Dalmia said this pause will help growth to become strong with the support of enhanced consumption demand in the economy.

“We look forward to the continuous handholding by the government and RBI to maintain economic growth and addressing inflationary pressures,” he said.

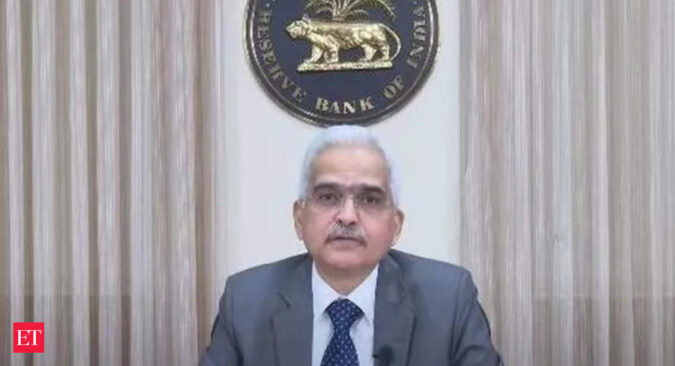

Announcing the bi-monthly policy, RBI Governor Shaktikanta Das said anchoring of inflationary expectations is underway and that the central bank’s monetary policy actions are yielding the desired results.

Dhruv Agarwala, Group CEO, Housing.com, said the status quo on benchmark lending rate augurs particularly well for the real estate sector in the country.

“Amid all growth indicators moving in the right direction, the consumer spirit would get a renewed boost from the RBI move, which means home loan interest rates would remain at the current level,” he said.

In his comments, Shiv Parekh, founder hBits, said while the immediate impact of the RBI’s decision might not be significant, this move brings a sense of stability to the real estate sector.

“It is crucial to assess the cumulative impact of previous rate hikes by the RBI, and by keeping the repo rate unchanged, the central bank has provided a sense of relief to various industries, especially real estate, which has been struggling due to consecutive increases in rates in recent months,” he said.

Ajit Banerjee, CIO, Shriram Life Insurance Company, said the RBI’s policy tone was balanced, but it remained non-committal on the decision on future rate actions by MPC.

Probably it is very unlikely if RBI would precede the US Fed in reversing its course of rate hikes in the future, he added.

Pranay Jhaveri, MD – India and South Asia, Euronet, opined that streamlining Bharat Bill Payment System will help integrate backend systems efficiently for a seamless experience, which could also bring new players to the table and improve the ad-hoc payment system.

It will be an advantage to bolster fraud monitoring and risk mitigation systems to ensure smooth online transactions, Jhaveri said.

To further enhance the efficiency of the Bharat Bill Payment System and to encourage greater participation, RBI has proposed to streamline the process flow of transactions and membership criteria for operating units.

Other measures announced on Thursday included allowing scheduled commercial banks to set their own limits for borrowing in Call and Notice Money Market, giving two more years to primary urban cooperative banks to achieve priority sector lending (PSL) targets, expanding the scope of e-RUPI digital vouchers issued by banks, and permit issuance of RuPay prepaid forex cards by banks.