Category: Finance

icici bank: Rs 4.58 crore stolen from ICICI Bank customers: Broke FDs, created overdraft and personal loan; how relationship manager executed fraud

Such was the addiction to stock market trading that a 26-year-old girl working as a relationship manager in ICICI Bank stole Rs 4.58 crore from…

What’s the difference between fiscal deficit, trade deficit and CAD?

Much like we handle our household budget, the ruling government of a country handles its finances and budgeting. As family members draw an income and…

Household finance mismanagement: Compulsive savings, lack of diversification won’t help you save more

The signs of a household’s personal financial troubles are easy to spot if one bothers to see them. Many of us think we need a…

How much risk can you take when investing? Know the difference between your risk tolerance and risk capacity

Siddharth Mehta, a young lawyer and senior partner in a top law firm, has taken insurance and has started investing for his goals. Seeking a…

Your step-by-step guide to retirement planning: Secure your future with confidence

Retirement might feel like a distant dream, but it’s something that requires planning from an early stage. The earlier you start, the easier it will…

All you need to know about claim settlement ratio

Be it life, health or any other type of insurance, buying a policy can be a confusing, if not an outright difficult, exercise, given the…

How to achieve financial stability amidst fluctuating income?

The economic volatility has created financial uncertainty for Jai and Manisha Sharma. Jai has been incurring losses in his 30-year-old kitchenware trading business, while Manisha’s…

Why some personal finance decisions you take need not be objective or right, but emotionally satisfying

Sometimes personal financial advice can appear cold. What seems like the right thing to do might not be acceptable for emotional and sentimental reasons. Human…

All you need to know about hybrid funds

What’s a hybrid fund? Hybrid funds are mutual funds that invest in a mix of different asset classes, primarily equity and debt, but also include…

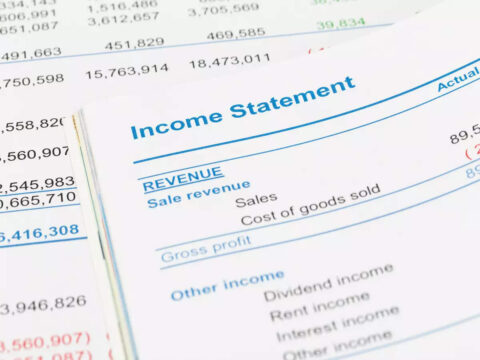

What are top line and bottom line in a company’s financial statement?

During stock-picking, if you are evaluating a company’s financial performance, an important document to scan is the income statement, also known as the profit and…