The latest meeting of the Reserve Bank of India’s Monetary Policy Committee (MPC) is the first after the presentation of the Union Budget. While the key decision to increase policy rate by 25 basis points was widely expected, MPC has also taken a stock of the larger economic situation. MPC’s assessment depends on economic variables released after its previous meeting and RBI’s own forward-looking surveys that are released after every MPC meeting. Here are four charts that summarise the state of the economy, as the MPC would have seen it

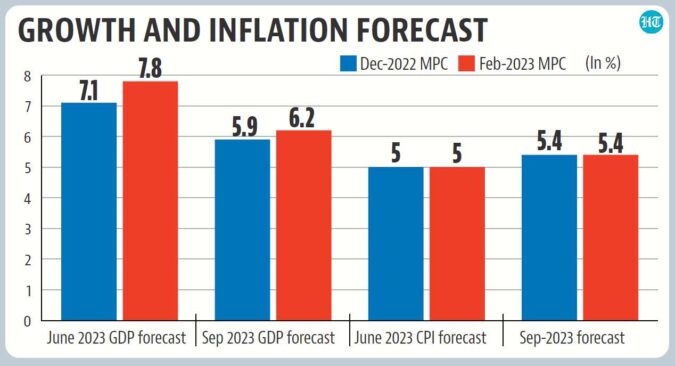

MPC has made an upward revision to its growth forecast for first half of 2023-24

The assessment of the MPC in its previous meeting ended up overestimating inflation in the December quarter (6.6% projected versus 6.1% actual) and underestimating growth for the fiscal year 2022-23 (6.8% projected versus 7% as per first advanced estimates released in January 2023). In its latest meeting, MPC seems to have taken a cue and has made an upward revision to its growth forecast for the first two quarters of 2023-24. To be sure, MPC’s overall growth projection for 2023-23 is 6.4%. This is ten basis points lower than the baseline projection of 6.5% by the Economic Survey, which has also projected a range of 6%-6.8% for growth. MPC’s inflation forecasts for quarters ending June 2023 and September 2023 are unchanged between its December 2022 and February 2023 resolutions.

An aggressive rate hike cycle has anchored, but not brought down inflation expectations

In theory, inflation targeting – it is the guiding framework of monetary policy in India – requires forward looking action by central banks, as interest rate changes work with a lag in generating headwinds or tailwinds for demand. This is why expectations of inflation are an as important, if not more, empirical input in this exercise than current inflation levels. Data from RBI’s household inflation expectations survey shows that inflation expectations stopped rising after the MPC started its rate hike cycle. However, they are still higher than what they were in the pre-pandemic period when inflation was not as a big a problem. Perhaps, this was one of the motivations in the MPC postponing the change of monetary policy stance from withdrawal of accommodation to neutral.

Private investment revival in manufacturing might not happen anytime soon

Evidence from the December 2022 round of RBI’s Industrial Outlook Survey suggests this. The share of respondents, who believe that their current production capacity is more than adequate to cater to expected demand – this means that fresh investment is not needed – has increased once again. To be sure, the survey also shows that level of capacity utilisation has been increasing, which rules out a contraction in economic activity.

Consumer confidence data underline the problem of K-shaped recovery

While the MPC resolution has underlined the trajectory of consumer confidence data which show a continuing improvement, a careful reading of the numbers paint a more sobering picture. Unlike the headline numbers on current and future situation indices in the Consumer Confidence Survey (CCS), its other metrics give a break-up of the share of respondents who have reported a worsening, improvement or no change on various fronts. It is here that the CCS data are worrying. For example, the net current assessment on general economic situation has improved from -48.9 to -23.7 – the number being negative means that more respondents reported a worsening than those who reported an improvement — between January 2022 and January 2023 round of the CCS. However, what should be of major concern is the fact that more than 50% of respondents in the January 2023 round of the CCS still reported a worsening in their assessment of the general economic situation. This number is 49.9% for the response on employment, 29.6% on income and 42.8% on non-essential spending. To be sure, the CCS is conducted in 19 major cities and therefore does not tell us about the mood in rural markets. If RBI has relied too much on rural markets providing ballast to the economy going forward, its projections may end up being critically dependent on the vagaries of the weather.