Aug 08, 2024 10:54 AM IST

The RBI keeps repo rates unchanged at 6.5% for the ninth time

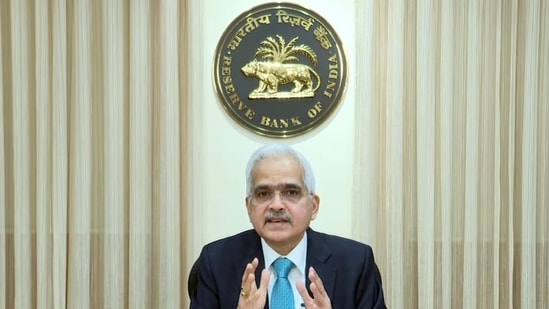

The Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 6.5% for the ninth time in a row, RBI Governor Shaktikanta Das announced on Thursday, August 8, 2024.

“The Monetary Policy Committee decided by a 4:2 majority to keep the policy repo rate unchanged at 6.5%. Consequently, the standing deposit facility (SDF) rate remains at 6.25%, and the marginal standing facility (MSF) rate and the bank rate at 6.75%,” Das said.

Also Read: Will there be a recession in US? JPMorgan says 35% possibility by end of 2024

Furthermore, the RBI’s Consumer Price Index (CPI) inflation forecast for the financial year 2024-25 has been maintained at 4.5%.

While headline inflation increased in June, driven mostly by increasing food prices, the base effect will pull down the headline inflation numbers in the third quarter, according to Das.

Also Read: Nirmala Sitharaman on LTCG amendment: ‘We have courage to change’

The RBI governor said that food prices are likely to have continued to be high in July also, adding, “A degree of relief in food inflation is expected from pickup in southwest monsoon.”

The limit for UPI transactions has now increased from ₹1 lakh to ₹5 lakh per transaction.

Also Read: How Warren Buffett cut losses with record cash reserve before stock market crash

Das highlighted that banks are struggling to meet credit demand due to falling deposits because retail investors are finding alternative investment avenues increasingly more attractive.

Earlier, the UPI transaction limit was up to ₹1 lakh per transaction in a day, but some specific categories like Capital Markets, Collections, Insurance, and Foreign Inward Remittances had a ₹2 lakh limit and for Initial Public Offering and Retail Direct Scheme, the transaction limit is up to ₹5 lakh per transaction.