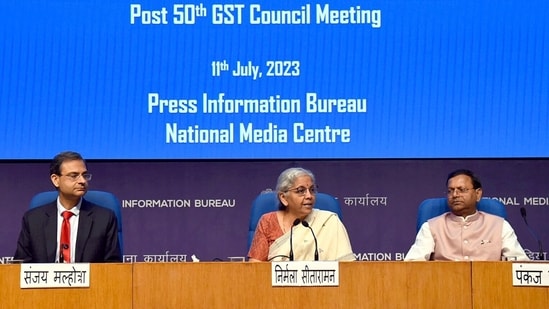

With the all-powerful GST Council agreeing to a slew of proposals at its 50th meeting on Tuesday, some items and services are set to be costlier while others to get cheaper. While the Council agreed to exempt cancer-related drugs, medicines for rare diseases and food products for special medical purposes from GST, it decided to impose a 28 per cent tax – the highest of the four slabs – on the turnover of online gaming companies, horse racing and casinos.

The decision to impose 28% GST is seen by many as a major setback to the country’s $1.5 billion industry. Foreign investors such as Tiger Global and Sequoia Capital have backed Indian gaming startups like Dream11 and Mobile Premier League, hugely popular for fantasy cricket.

The GST Council had earlier formed a panel to look into taxing casinos, horse racing and online gaming but couldn’t decide whether to impose a 28% GST on the face value of bets, gross gaming revenue, or just on platform fees. Roland Landers, CEO of The All India Gaming Federation, said that the Council’s decision to levy tax on full face value means that GST will be applicable to gross revenue/total prize pool, reported Reuters.

“We believe this decision by the GST Council is unconstitutional, irrational, and egregious,” Reuters quoted Landers as saying.

Items and services that will likely get cheaper:

Uncooked/unfried extruded snack pallets

fish soluble paste

Imitation zari threads

Cancer-fighting drugs

Food for Special Medical Purposes (FSMP) used in the treatment of rare diseases

Food in cinema halls

Satellite launch services provided by private organisations

Items and services that will likely get costlier:

Online gaming

Casinos

Horse racing