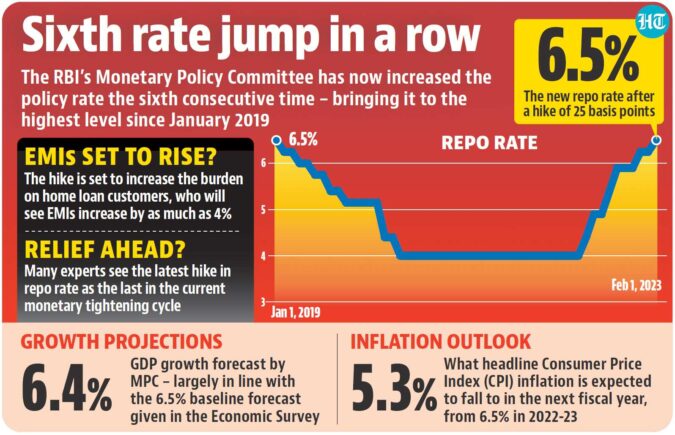

The Monetary Policy Committee (MPC) of RBI increased the policy rate for the sixth consecutive time on Wednesday, with the latest 0.25 percentage point hike taking the policy rate to 6.5%, a level last seen in January 2019, increasing the burden on home loan customers, who will see their EMIs (equated monthly instalments) increase by as much as 4% in some cases.

The actual increase in the EMIs will be a function of the tenure and the amount of the loan, but the 2.5 percentage point increase in the policy rate (including the latest one) since May 2022 has seen monthly payments on long-term high-value home loans increase by as much as 23-25%.

The hike, which many experts see as the last in the current monetary tightening cycle, will also raise the borrowing cost for corporate borrowers, increasing the cost of capital.

MPC expects GDP growth of 6.4% for 2023-24, which is largely in line with the 6.5% baseline forecast given in the Economic Survey. The inflation situation is expected to improve significantly in the next fiscal year, with headline Consumer Price Index (CPI) expected to fall from 6.5% in 2022-23 to 5.3%. A key factor in the RBI’s inflation forecasts is an expected moderation of crude oil price from $100 per barrel to $95 per barrel, both of which are higher than the current price ($80.8 per barrel on January 7).

While the rate hike and its quantum was in line with analyst estimates, MPC’s decision to retain a withdrawal of accommodation stance for monetary policy has conveyed a slightly hawkish message on part of the central bank. To be sure, there was a division of opinion within MPC on both the rate hike and policy stance with two external members voting against this decision.

A research note by Soumya Kanti Ghosh, group chief economic adviser at State Bank of India, seems to echo the sentiments of the dissenting MPC members. The note cautioned the central bank against falling into a “self-fulfilling prophecy” of central banks of emerging markets playing catch-up with rate hikes by the US Fed and termed the April meeting of MPC as an important juncture in this challenge.

While most analysts do not see more rate hikes in the near future, they do believe that MPC’s latest projections overestimate both inflation and growth. “In our view both, growth and inflation could turn out to be below RBI’s expectations,” Aurodeep Nandi, India Economist and Vice President at Nomura said in a note, adding that “the policy arithmetic has changed from ‘de-facto’ policy tightening, to a distinctly data dependent mode”. “We think RBI’s inflation projections, while lowered, are still too high still, and we also expect growth in FY24 to be lower than its forecast,” Rahul Bajoria, MD & Head of EM Asia (ex-China) Economics, Barclays, said in a note.

With the rate hike expected to add to borrowing costs, headwinds for domestic growth are expected to increase. “The continuous increase in repo rate will have impact on consumption demand and production possibilities in factories. As world demand is slowing down, at this juncture, domestic demand is a major support to sustain the economic growth” Saket Dalmia,president, PHD Chamber of Commerce and Industry, said in a note. The repo or policy rate is the interest rate at which the central bank lends to commercial banks.

The MPC resolution suggests that it is banking on rural demand, a rebound in contact intensive sectors and discretionary spending to boost urban consumption, and hoping that the government’s capital spending and infrastructure focus will “create a congenial environment for investment”. To be sure, it notes the headwinds to growth from slowing exports.

While consumer confidence, as measured by RBI’s consumer confidence survey – it is carried out in 19 major cities – continued to improve, the current situation index remains in negative territory which raises questions about the extent of stimulus private consumption can generate in case exports slow significantly.

“While we are expecting no more rate hikes in FY24, we do not expect any rate cuts either. Inflation is likely to moderate but the 4% inflation target is not in sight. Core inflation remains elevated due to several structural changes such as more pricing power with large firms, adverse climate events keeping food prices volatile and permanently raising inflation expectations, and a host of import tariff increases raising the cost structure of the economy”, Pranjul Bhandari, chief India and Indonesia economist, HSBC said in a note. “All said, we’re likely to be in a period of high for longer,” Bhandari added.

The latest MPC comes in the wake of controversy over a sharp fall in stocks of Adani group of companies after a report for US based short-seller. To be sure, the controversy had not had much of an impact on the benchmark stock market index.

While neither the MPC resolution nor the Governor’s statement made any explicit reference to the controversy – RBI earlier issued a statement that the group does not pose any systemic risks to Indian banks – Governor Shaktikanta Das did drop a subtle hint that the controversy will not have any impact on the long-term perception of the Indian economy. “It is heartening to note that the Indian economy successfully dealt with multiple major shocks in the last three years and has emerged stronger than before. India has the inherent strength, an enabling policy environment, and strong macroeconomic fundamentals and buffers to deal with the future challenges”, Das said. “Never lose your faith in the destiny of India,” he added, quoting Subhas Chandra Bose to send out a reassuring message to foreign investors without going into particulars.