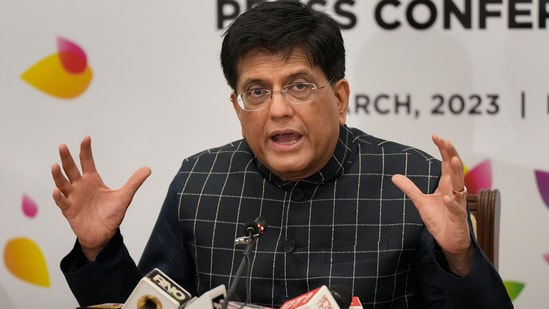

Union commerce and industry minister Piyush Goyal on Friday announced the Foreign Trade Policy 2023, breaking the tradition of setting a five-year goal and adopting a ‘long-term’ focus. The minster said there is no end date to the policy and it will be updated as and when be necessary.

Among other focus areas, the new policy aims to push towards internationalisation of Rupee in foreign trades. Directorate general of foreign trade Santosh Sarangi said the total exports in the financial year 2023 is projected to cross $760 billion, almost 90% more than 2021-22 with $676 billion worth of exports.

Also read: Centre launches Foreign Trade Policy 2023, aims $2 trillion exports by 2030

What is internationalisation of Rupee?

Internationalisation of Rupee refers to the process of increased cross-border transaction of Indian currency, especially in import-export trades leading to other current account transactions and then capital account transactions. This would allow the international settlement of trade in Indian rupees in foreign trades.

The effort to ‘internalionalise’ rupees comes after the Reserve Bank of India (RBI), on July 11, 2022, allowed the settlement of foreign trades between partner countries in Indian currency. It was announced in the backdrop of continuous weakening of rupee against the US dollar and the sanctions put on Iran and Russia by the United States on the use of their currency for transactions.

Note: Current account is used to deal in export and import of goods and services, whereas, capital account is made up of capital through cross-border transaction in the form of investment and loans.

Why do we need to internationalise Rupee?

The US dollar dominates the foreign trade with around 88.3% turnover in the global foreign exchange market. It is followed by the Euro, Japanese Yen and Pound Sterling. Whereas, Rupee has a turnover of mere 1.7%. It gives US an edge over others and allow them to pay for its external deficits with its own currency, giving immunity from balance of payments crises.

How will it work?

With this effort, Indian importers can make payments using rupee to a special account made in the name of exporter from the partner country in an Indian bank. Similarly, Indian exporters will also be paid in a special account made in its name in a bank of the importer’s country. The transaction will be made at a market determined exchange rate. This way there will be no real cross-border transaction of currency, despite both importers and exporters being paid in full amount.

Special bank accounts are called Vostro accounts. The surplus in these accounts could be used for investments in government securities of the host countries and make other payments.

What are the advantages of this?

The most important advantage of internationalising Rupee is to reduce dependency in US dollar for foreign trade and eventual reduction of holding foreign exchange reserves. It further protects India from external economic shocks. It would further increase the bargaining power of India in international business.