The Department for Promotion of Industry and Internal Trade (DPIIT) on Thursday brought deeptech startups under the ambit of the Startup India programme.

Long-term commitment

As per a gazette notification, a deeptech startup is one that is developing solutions where the technology is “yet to be developed” or “in the process of being developed”. Such startups will now be able to avail themselves of benefits such as a tax holiday prescribed under the scheme for a longer period. Entities registered with the DPIIT can carry forward accumulated losses for up to 20 years from incorporation, or until they reach Rs 300 crore in turnover, whichever comes earlier, enabling them to offset these losses against future profits and lower tax liabilities. For non-deeptech startups, the window is 10 years or up to Rs 200 crore in annual turnover.

ETtech

ETtech“Deeptech companies are built over long cycles and they need sustained capital and regulatory stability to survive them,” a Bengaluru-based deeptech founder said.

“While these benefits are not massive in the sense that they allow access to any infrastructure necessary for R&D, such small incentives add up and are necessary. It allows founders to commit to building long-term durable businesses without worrying about short-term milestones.”

In addition to the tax sops, these startups will be able to access collateral-free loans, an 80% reduction in patent filing fees and eased public procurement rules.

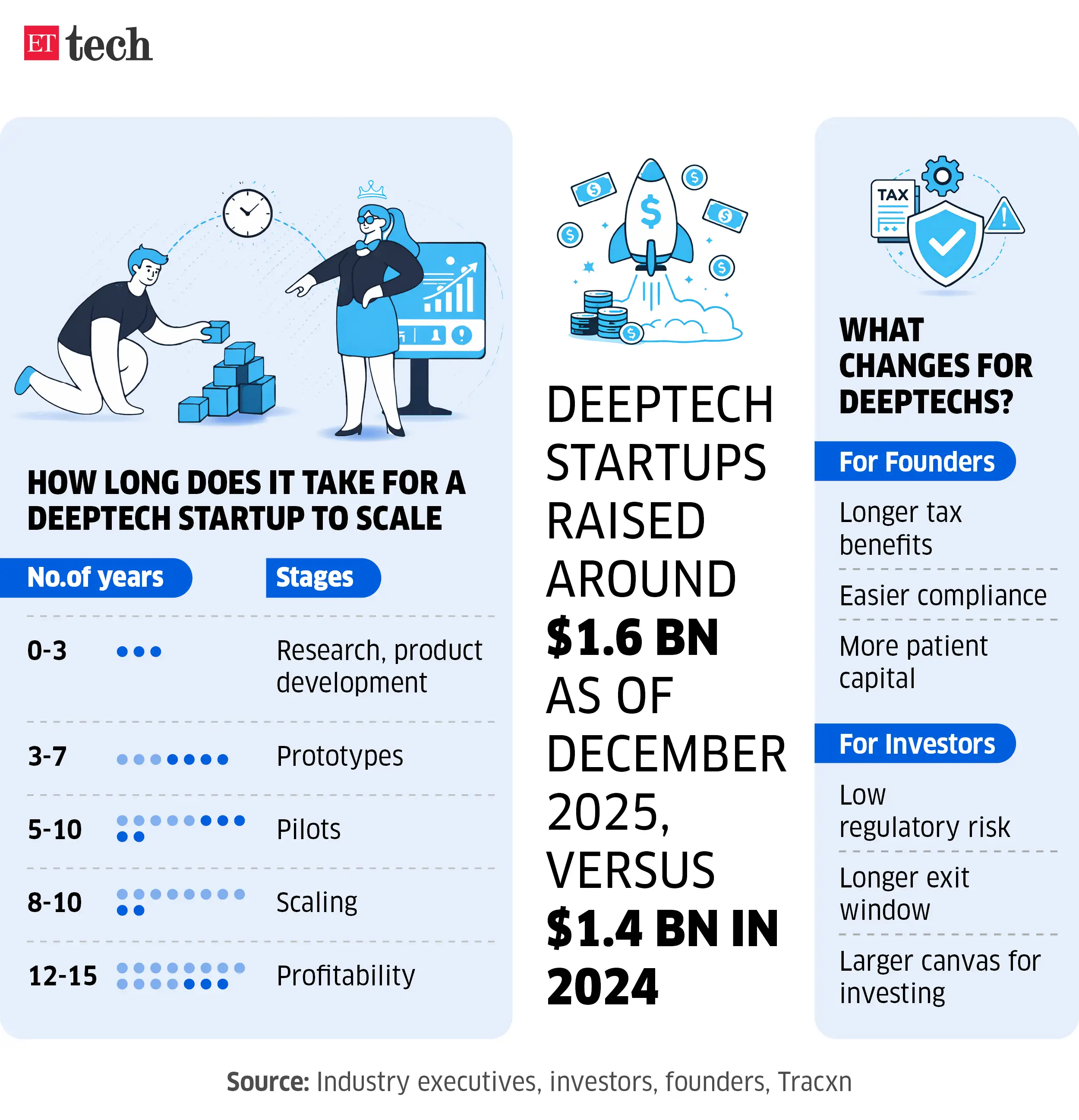

Deeptech companies typically face extended development timelines, long gestation periods, high capital and infrastructure requirements, and carry large technical or scientific uncertainty.

“For a typical deeptech startup it takes about seven to eight years to move from lab to first revenue,” said Vishesh Rajaram, founding partner at venture capital firm Speciale Invest. “The (government) move sends a clear signal that the country is serious about building IP-driven deeptech companies from India for the world, and gives founders and investors the confidence to commit long-term capital to that journey.”

Speciale Invest has backed deeptech startups such as GalaxEye, MetaStable Materials and Morphing Machines.

Deeptech startups raised around $1.6 billion in equity funding in calendar year 2025, according to latest numbers from data intelligence platform Tracxn, marking an 11-12% increase over the $1.4 billion in 2024.

The fundraising momentum has continued into early 2026, with warehouse automation and logistics startup Unbox Robotics ($28 million), advanced materials firm Whizzo ($15 million), aerospace components maker JJG Aero ($30 million) and spacetech startup EtherealX ($20.5 million) raising funds. Several early-stage startups also raised funds for the first time since the beginning of this year.

Recognising lab to market journey

Over the past few years, the government has recognised the need for patient capital in the ecosystem. Its Rs 1 lakh crore Research Development Innovation fund, Rs 10,000 crore Fund of Funds for early-stage startups and the Antariksh Venture Capital Fund anchored by space industry regulator IN-SPACe reflect a broader push towards backing long-gestation innovation and capital infusion.

Startups working in areas such as AI and related infrastructure, biotechnology, climate tech, spacetech, semiconductors and quantum technologies are likely to benefit from the latest DPIIT move.

Investors said deeptech companies were losing startup status just as they approached commercial viability. A 20-year recognition period allows founders to access tax benefits, grants and regulatory support across the full development lifecycle, not only during early R&D.

“Venture funds with 10-year lifecycles have long been mismatched with company timelines that often extend to 15 years or more,” Endiya Partners managing director Sateesh Andra said. This policy removes a structural friction that previously made India less attractive for deeptech investment, he said.

Globally, Andra said, China’s deeptech funds operate on 12- to 15-year horizons, while Israel’s Yozma programme understood this need in the 1990s. “India has now caught up, and it has done so with regulatory clarity that many other ecosystems still lack,” he said.

Endiya Partners has backed deeptech startups such as BluJ Aero, Maieutic Semiconductors and energy storage startup Cygni.

Vijay Muktamath, founder and CEO of Sensesemi, a fabless semiconductor startup which recently raised its seed-funding, said “For fabless semiconductor startups, building the technology can take five years and commercialisation another two, pushing timelines beyond a decade.” A 20-year window gives founders the confidence to invest in long-term R&D, he said.

On the government’s move of increasing the revenue threshold from Rs 100 crore to Rs 300 crore for deeptech startups, Ajay Modi, investment director, Piper Serica Fund said startups develop products and get their first validation or trials from government institutions- such as iDex, DRDO, receiving Rs 100-200 crore contracts.

“But it does not mean they have stable, recurring revenue. By increasing the threshold to Rs 300 crore, it removes the risk of a startup losing its status because of one large validation contract,” he said.