ETtech

ETtechThe early bird, indeed, caught the worm this year.

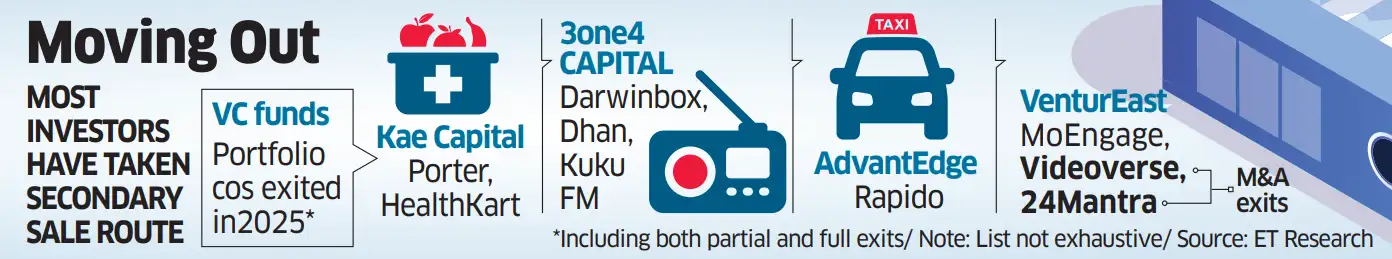

A partial, 30-bagger exit from bike-taxi startup Rapido, a 10x outcome from MoEngage, and early liquidity from companies yet to file for IPOs: Multiple outsized venture returns in 2025 have come from smaller, early-stage investors that typically write the first cheques for businesses often in the cradle.

Their exits, often via partial secondary sales well before public listings of the companies they bankrolled, point to a maturing monetisation ecosystem that extends well beyond late-stage capital.

To be sure, a raft of bulge-bracket public listings, which even partially offset the impact of persistent secondary-market exits by overseas portfolio investors, helped. A slew of new-age companies including Lenskart, Meesho, PhysicsWallah, Urban Company, BlueStone, Ather Energy and Groww went public — delivering multifold returns for their shareholders. These IPOs saw investors with larger capital pools, such as Peak XV Partners, Accel, SoftBank, Tiger Global and Elevation Capital, mark exits from their portfolio firms.

Sasha Mirchandani, founder and managing director of Kae Capital, said strong public markets have played a catalytic role. “When markets are healthy and IPOs are happening, it’s the right time to take some money off the table,” he said. “We try to do this in stages within a fund while still holding on to our best companies till the end. If you don’t stay invested in your winners, you can’t deliver exceptional returns.”

ETtech

ETtechShortening the cycle

Kae Capital, which is currently raising a $100-110 million new fund, has already seen its investment in logistics startup Porter generate more than a two-times return on its first $25-million fund. Separately, its investment in HealthKart has returned the entire Fund I capital through a partial exit, with further upside still to come.

Mobility-focused fund AdvantEdge delivered one of the year’s standout outcomes with a partial exit in Rapido, earning a 30-fold return on invested capital from a partial sale of its stake to Prosus. AdvantEdge, which is in the process of raising a $60-million fund, had first backed Rapido in 2016.

VenturEast, meanwhile, secured over a ten-fold return from customer engagement SaaS firm MoEngage through a secondary transaction that closed last month, besides scoring exits from organic food products maker 24Mantra and AI video editing startup VideoVerse through M&As.

Early-stage investor 3one4 Capital has also logged a series of partial and full exits across portfolio companies including stockbroking platform Dhan, audio content startup Kuku FM and enterprise SaaS firm Darwinbox.

Multiple investors that ET spoke with said smaller funds are increasingly able to return capital without waiting a decade for IPOs.

Porter, for instance, is in the midst of closing an extended $300-310 million funding round led by private equity firms Kedaara Capital, Wellington Management, Vitruvian Partners and others. The first part of the round saw early backers including Kae Capital and Lightrock partially offload their stakes. “We exited a significant portion but retained a meaningful holding so we can participate further when the company goes public,” Mirchandani said.

Kae Capital also expects exits from portfolio companies including manufacturing startup Zetwerk and real estate marketplace SquareYards, he added.

Beyond IPOs

For many early-stage investors, secondary transactions are the fastest and most reliable exit route. India’s M&A market remains relatively underdeveloped, but that too may evolve as more companies list and public market players look for inorganic growth, said a Bengaluru-based investment banker.

Pranav Pai, founding partner and chief investment officer at 3one4 Capital, said IPOs are not the only viable endgame.

“Many of our companies raise large late-stage rounds well before going public,” he said. “In cases like Kuku FM, Dhan and Darwinbox, we participated as secondary sellers, allowing us to return capital to investors and rotate it efficiently.”

Dhan, which 3one4 Capital first backed in a $22 million round in 2022, closed a $120 million funding earlier this year at a $1.2 billion valuation, significantly higher than its previous round. The deal resulted in a partial exit for the firm, alongside substantial paper gains.

Audio and video content platform Kuku FM, which raised seed capital in 2019 from 3one4 Capital and IndiaQuotient, closed an $85 million funding round in October that also led to exits for early investors. According to a Bloomberg report, the company has appointed Kotak Mahindra Capital, Axis Bank and Morgan Stanley for a planned $200 million IPO.

IndiaQuotient, which closed its $129 million fifth fund in October, has previously delivered notable exits from companies including ShareChat and Giva.

At VenturEast, partner Vinay Rao said flexibility on exit timing has become essential. “MoEngage is clearly on the path to an IPO, possibly in a couple of years, but we’ve been invested long enough and needed liquidity, so we chose to do a secondary,” he said.

Rao also pointed to VideoVerse, which was acquired by US-based Minute Media. “It operates in AI, where innovation is moving extremely fast and capital requirements are massive,” he said. “Trying to compete independently with a few hundred million dollars on the balance sheet in a market seeing trillions of dollars of investment doesn’t work. Consolidation made more sense than waiting for an IPO.” VenturEast portfolio firms in the fintech space Kissht and Acko are also preparing for their public markets debut.

For early-stage venture capital firms, Rao said, exits now come in multiple forms. “IPOs aren’t the only route, though they’re still the most satisfying when they happen. Secondaries and M&A have become equally important tools…and that’s a sign of an ecosystem that’s finally starting to work end to end.”

The timing of these exits also assumes significance as these VC firms set out to raise their next vehicles. “We’ll launch a new fund next year but we are already getting a lot of inbound conversations…are in the radar of high quality LPs (limited partners, or fund sponsors) who believe that at the end of the day, it’s all about exits,” said Kae Capital’s Mirchandani.

Source link

https://www.infinitycompliance.in/product/online-company-registration-in-india/