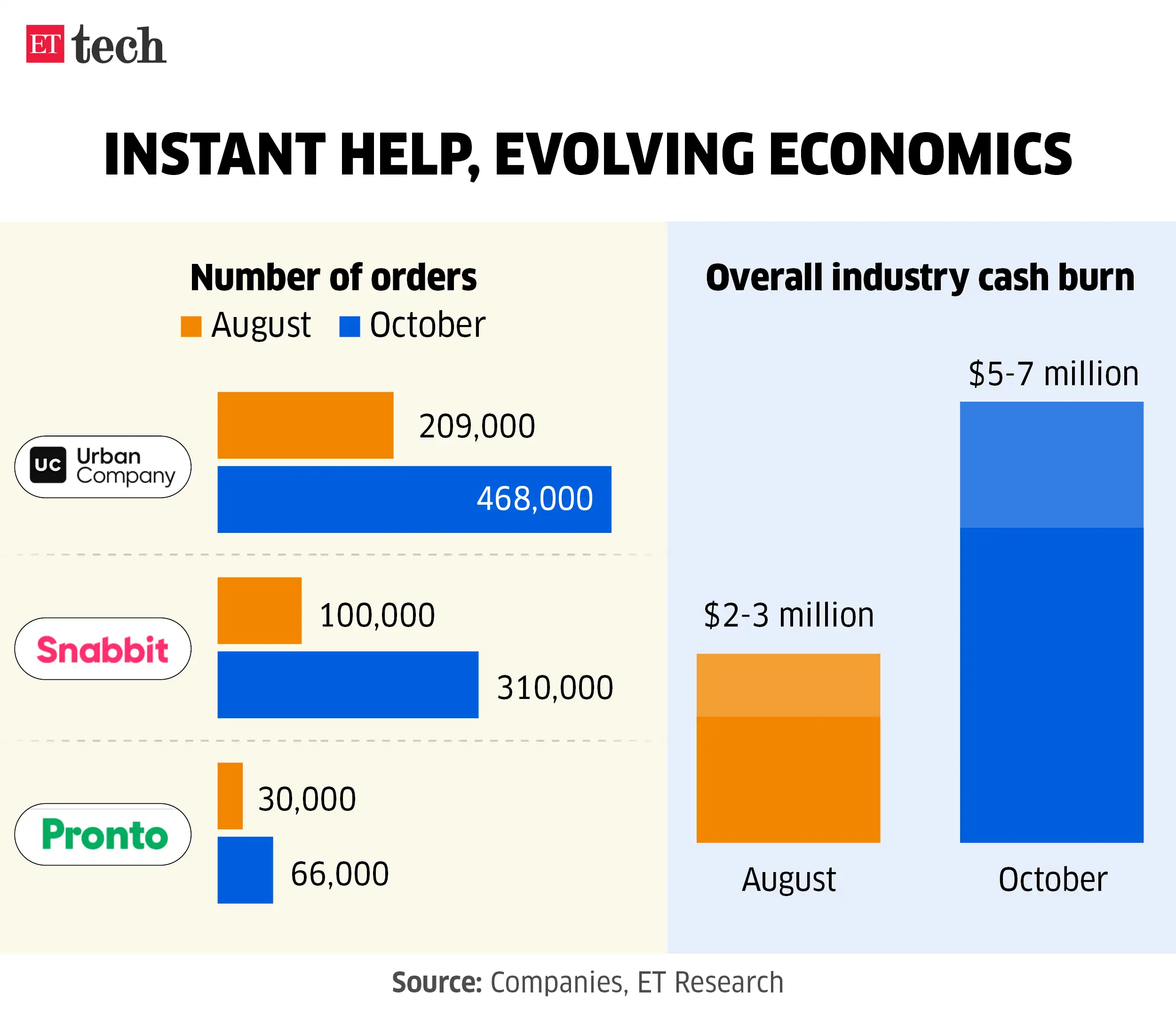

The scale-up has been sharp. In August, Urban Company fulfilled 2,09,000 InstaHelp orders; Snabbit handled around 1,00,000; and Pronto completed 25,000-30,000, according to industry estimates. By October, those numbers had surged to 4,68,000 for Urban Company, 310,000 for Snabbit, and 66,000 for Pronto.

This early momentum, however, has come with a fast-rising bill. According to multiple industry executives and investors, the segment’s combined burn had jumped from about $2-3 million per month in August to nearly $5-7 million by October. A bulk of this capital goes into acquiring and retaining supply, funding discounts, and seeding behaviour among first-time users, many of whom still treat the service as a back-up rather than a daily habit.

Investors argue that the category is attempting to capture a service segment with a potentially large addressable market. “The estimate of the addressable market size is around $30-40 billion, growing 12–14% every year. All of that may not be immediately available, the top 20 markets may account for the bulk of it,” said Rahul Taneja, partner at Lightspeed, a Silicon Valley headquartered venture capital fund.

ETtech

ETtechThe focus, he said, would remain on increasing frequency, drawing a parallel with value ecommerce marketplace Meesho, which listed earlier this month. “These are short jobs and typically priced low to match the duration,” he said, adding that manpower acquisition and utilisation will matter more than driving up demand.

Suvir Sujan, cofounder of Nexus Venture Partners, told ET earlier this month, while announcing the firm’s latest $750 million fund, that its portfolio firm Snabbit is attempting to crack the bottom-of-the-pyramid service — daily house-cleaning — before scaling into adjacent categories. “If Snabbit builds trust and predictability in daily cleaning, it can scale into adjacent categories the way Rapido did. The biggest problem is generating consistently reliable manpower supply,” he said. Nexus is a significant shareholder in urban mobility startup Rapido too.

Investors are cognisant of the capital needed for scaling this space, but are also cautioning that founders need to be efficient. “These are not software businesses. These are real supply-chain, physical-world businesses. See what Flipkart and Amazon did, for how many years they had to fund the capital (required). These businesses take time, money, and sustained investment to really scale and get to hundreds of millions of users. I think the proof of the pudding has to be that users need it and that they keep coming back for new services,” said Neeraj Arora, managing director and India CEO of General Catalyst, which has backed Pronto.

Also Read: General Catalyst to ramp up investments in manufacturing, AI

“Founders need to make sure that these businesses, while burning cash, are run efficiently. Are processes being automated and are they being careful about spending? That’s very important. We keep an eye on these things,” Arora said.

ETtech

ETtechPrice of blitzscaling

The scramble by the three companies is typical of early internet categories, where upstarts subsidise behaviour first and figure out unit economics later. “The househelp segment is a very different beast from food delivery or mobility. Labour supply is hyperlocal. Reliability matters more than speed. And unlike ride-hailing, most households already have a relatively cheaper offline alternative — a daily maid,” a senior industry executive said.

As a result, these companies are betting on different levers to make the business sustainable.

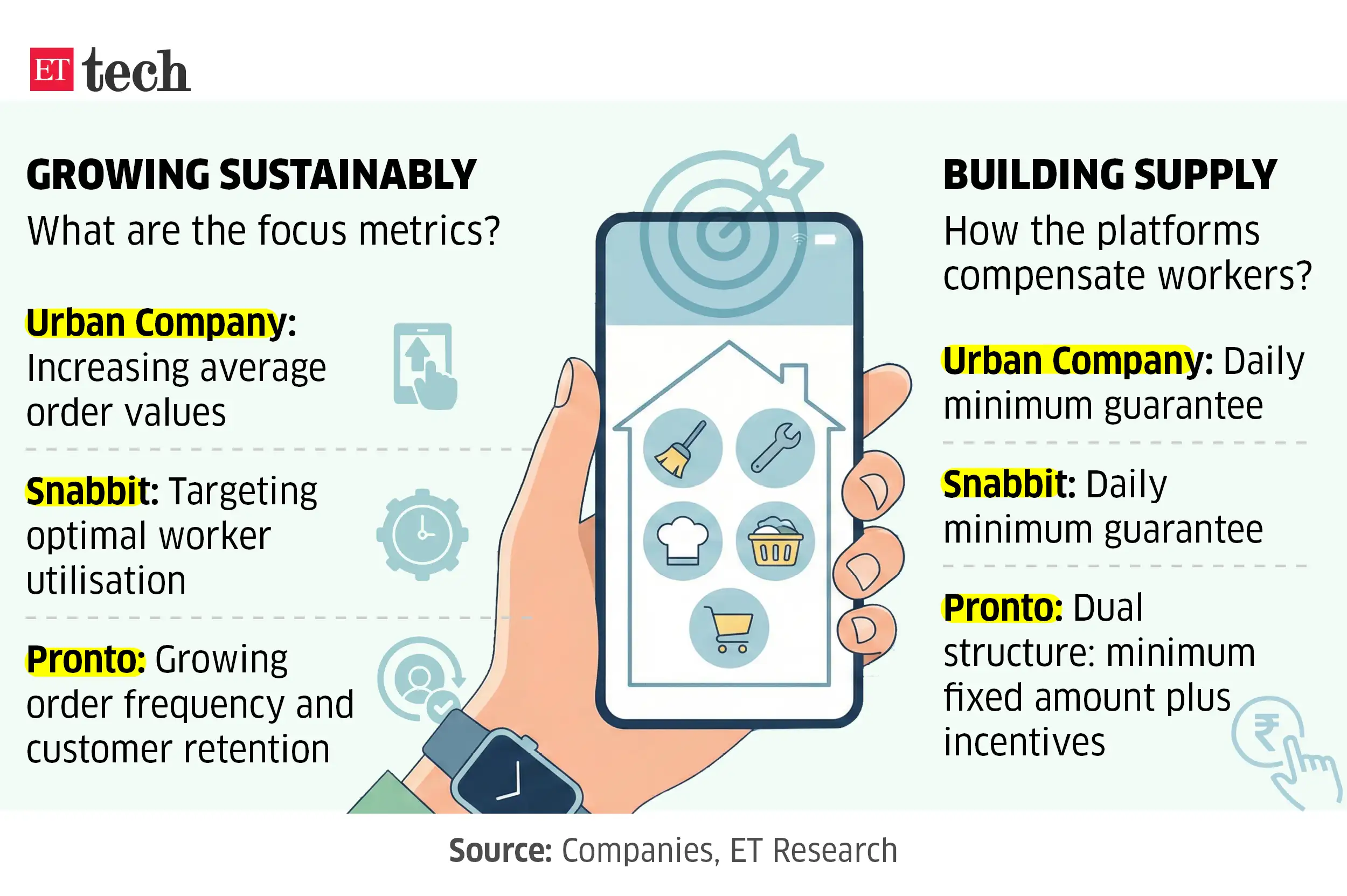

Urban Company CEO Abhiraj Singh Bhal has been blunt about what must eventually change. “The average order value has to go higher. Discounting needs to come down. Densifying the network will matter,” he said on the firm’s earnings call in October, adding that InstaHelp has to improve margins and chart a path to breakeven. He also underscored that it is too early to know what steady-state unit economics will look like, noting that the category is competitive, consumers are experimenting, and the frequency curve is still being shaped.

Urban Company, which went public in August this year, has a decade-long head start in home services, labour-training infrastructure in major cities, and a large team. InstaHelp gives it an entry point into a high-frequency, daily-use category, unlike its traditional portfolio of haircuts, beauty, or deep cleaning, which are comparatively infrequent. That is why it is leaning in aggressively and competing head-on with venture-backed startups, even as a public company.

Snabbit and Pronto, who are much earlier in their journeys, have developed their own views on how the category will mature.

For Snabbit, utilisation, or the extent to which a worker is engaged on the platform, is the metric on which it is indexing the model’s viability. Founder and CEO Aayush Aggarwal, a former Zepto executive, told ET that if a worker stays occupied for over 65% of the day, the model turns profitable. Everything else, he said, flows from that, whether it is network design, density, planning, or predictable demand within a tight geographic cluster. “This is an asset-light business,” he said. “No warehousing, no inventory, negative working capital. You’re only paying for the person’s effort. If you hit the right utilisation, you make money.”

Also Read: Quick service app Snabbit strengthens leadership, shifts headquarters to Bengaluru

Snabbit was founded in 2024 and went through multiple experiments before finding traction with its short-format cleaning model. Investors such as Nexus, Lightspeed, Elevation Capital, and Bertelsmann India Investments have ploughed almost $60 million into the startup. It is now in discussions with multiple investors to raise $100-120 million at a valuation of more than $500 million, people in the know said.

Pronto, also founded last year, is focussing on the “primary” use-case — daily customers who could eventually use the platform to replace or supplement traditional housekeeping. It sees this as tougher but more defensible than the “supplementary” use-case, which spikes during absenteeism or festive cleaning and is currently buoyed by discounts. The startup has raised close to $13 million from General Catalyst, Glade Brook Capital, and Bain Capital Ventures, and is in discussions with large growth-stage investors for its next round of capital infusion. It last raised $11 million in a round that valued it at $45 million.

Pronto founder and CEO Anjali Sardana believes frequency is the real signal of product-market fit. “If the business never goes past the absenteeism use-case, it will be very hard for this to become a real category,” she said. “Absenteeism is important, but not big enough to support three players. This becomes meaningful only when people use the service every day,” she told ET.

Two behaviours shaping demand

Most users in the 10-minute househelp category fall into one of two buckets. In the primary use-case, customers have daily or near-daily reliance on the service. “This is the holy grail — a household hiring a cleaner every morning, building habit and predictability. It requires trust, punctuality, and consistent quality. Here, the frequency can be 20–30 services per month,” a senior industry executive said.

In the supplementary use-case, currently deployed by Snabbit and Urban Company, there is a spike in demand during househelp absenteeism, festive rush, or for specific chores. “Frequency here is low, generally 2–6 times a month, but most early growth in the category has come from this segment, driven in part by introductory discounts,” the executive added.

Investors say the supplementary layer is the natural entry point. Taneja said the category is still evolving and it remains unclear whether it moves meaningfully beyond that layer. But its on-demand nature helps build early trust. “Booking help as needed, not in advance, matters to the consumer,” he said.

However, a section of the industry believes low ticket sizes will continue to pressure the economic model. An investor who has backed a player in this space said the long-term solution lies in “variable leverage” — access to a trained labour pool that can be used across demand peaks. These workers must be willing to operate at certain payout levels, and platforms must route enough jobs to them at high utilisation.

Over time, the economics hinge on raising prices once user trust is established. “Five years from now, a trained cleaner arriving on time, consistently, offering predictable quality, will command better pricing,” the investor said. In the early phase, discounts are an acceptable trade-off, as long as customers stick after the first few services.

Aggarwal sees this as an investment rather than a crutch. “You can give the first service for free if you know the customer will return for the next 30,” he said. “Discounting the first one or two bookings is fine if you’re confident they’ll keep coming back.”

Urban Company is more cautious. Its core business has long focussed on raising average order values (AOVs) and premiumising services, so a low-AOV, high-frequency product is a new muscle. Bhal has emphasised the need to increase order values and reduce discounts, suggesting InstaHelp will need a different maturity path from the company’s other categories.

Urban Company reported a post-discount AOV of Rs 184 in October. Sardana said Pronto’s pre-discount AOV was around Rs 250 in the same month, with discounts ranging between 15–20%, and changing month to month. Aggarwal declined to share Snabbit’s AOV.