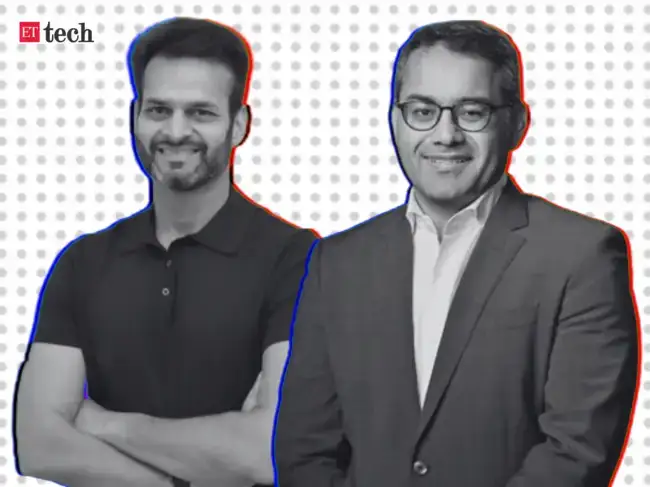

According to the document, the company plans to raise up to Rs 300 crore through a fresh issue, along with an offer for sale (OFS) of up to 6.38 crore equity shares. As part of the OFS, SoftBank and Nexus Venture Partners, among others, will divest part of their holdings. Cofounders Kunal Bahl and Rohit Bansal will retain their entire stakes.

AceVector said it will use the proceeds from the fresh issue for marketing and business promotion, strengthening the technology infrastructure of the Snapdeal marketplace, inorganic growth via acquisitions, and for general corporate purposes.

The company received Sebi’s approval for its initial public offering (IPO) on November 17. AceVector had earlier filed its draft red herring prospectus under Sebi’s confidential route in July. Besides Snapdeal, it owns over 28% of ecommerce software platform Unicommerce, which is listed independently, and also controls Stellaro Brands, a house-of-brands venture.

The confidential filing route allows companies to adjust the issue size in the early stages, including revising the number of fresh shares by up to 50% before submitting the updated DRHP.

For the six months ended September 30, the company reported Rs 244 crore in revenue from operations and a loss of Rs 22 crore. For the year ended March 31, Wakefit reported Rs 395 crore in operating revenue and a loss of Rs 126 crore.

As ET reported earlier, a clutch of new-age firms— Urban Company, Lenskart, Groww, Ather Energy, Bluestone, and Pine Labs — that have debuted on the public markets this year have collectively unlocked more than Rs 15,000 crore ($1.6 billion) in liquidity for early and late-stage investors.