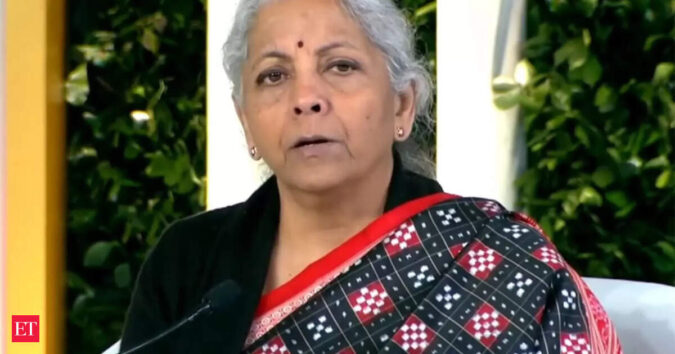

Speaking at the HT Leadership Summit, Sitharaman underscored the urgency to simplify customs procedures and make them more transparent. “We need to make them a lot more simplified for people to feel that it is not too tiresome, cumbersome for them to comply with the expectations and rules,” she said. “A complete overhaul of the customs area is on the cards.”

The minister noted that India generally aligns its standards with the World Customs Organisation (WCO) and keeps pace with global benchmarks.

Customs authorities handle the collection of tariffs and regulate cross-border movement of goods — including vehicles, hazardous materials, animals, and personal belongings.

Sitharaman said the government has steadily reduced customs duties over the past two years and will review the remaining items where tariffs remain above optimal levels. “In those few items where we are still considered to be over the optimal rate, we will have to bring them down as well. So customs is my next big cleaning-up assignment,” she said.

Drawing a comparison to past tax reforms, the finance minister recalled how India’s income-tax regime had once been plagued not by high rates but by the administrative burden, which had even given rise to the term “tax terrorism.” She emphasised that reforms such as faceless assessments have since made the system “cleaner and less intimidating,” and similar improvements must now be brought to customs.

However, she cautioned that the task involves a delicate balance — making processes smoother while ensuring strong safeguards against illicit or contraband goods. She suggested whether enhanced scanning technologies and reduced direct contact between consignments and customs officers could help minimise discretion and build trust. Reiterating the government’s direction, Sitharaman said customs reform remains a priority agenda in the broader economic reform pipeline.

(with inputs from ANI)