The BSE Sensex, India’s benchmark stock market index closed at 80,502.8 on Monday, 102.5 points lower than Friday’s close. The Sensex has dipped by 0.27% between July 16 and July 22. Does this mean the markets are nervous before the government presents its budget?

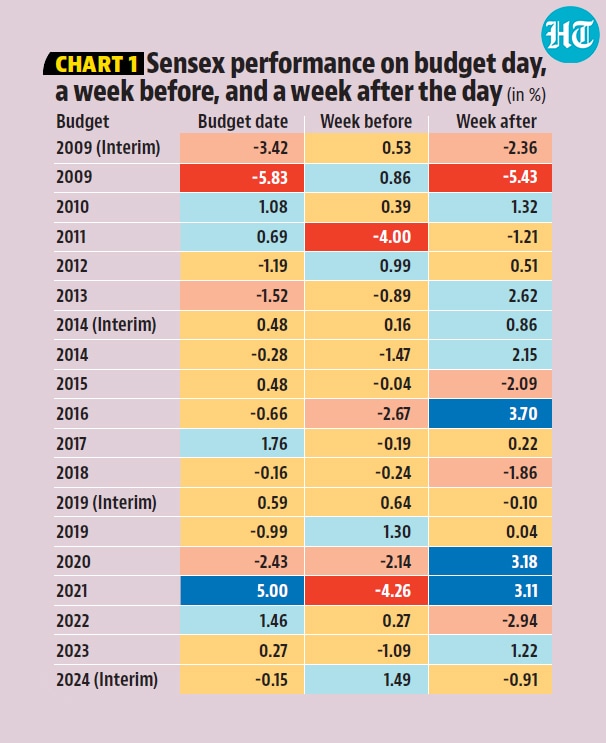

An analysis by HT shows that the markets turning red before the budget is nothing out of the ordinary. In fact, in 10 out of the 19 budgets presented since 2009 including interim budgets, the markets have given negative returns over the week before the budget. This is largely because investors often tend to reduce their investments in the owing to uncertainty regarding budget announcements. To be sure, markets are affected by many domestic and international factors and it would be wrong to attribute movements a week before the budget to just budget related anxieties.

The biggest jump in the stock market during the week before the budget came before the 2024 interim budget, when Sensex rose by 1.49%. The biggest fall happened in 2021, when Sensex fell by as much as 4.26%. However, 2021, also saw the biggest single day rise during the day of the budget, as can be seen from the chart 1.

On the other hand, although markets tend to remain volatile for a short time after the budget, historically, they have more often than not managed to end in the green the week after the budget day. Out of the 19 budgets analysed, in as many as 11, the markets remained positive. The biggest such spike the week after the budget was seen in 2016, when BSE Sensex went up 3.7%. Overall, in four out of the last 19 budgets, the market has managed to remain in green both the week before and the week after the budget day.

Budgets are not a good indicator of the long term performance of markets

While the budget and the days around it are marked by market volatility, it isn’t a good idea to make plans for significant investments in anticipation of announcements made in the budget, according to analysts. “While there tends to be significant volatility leading up to and immediately after the budget based on expectations, the longer term is driven by the underlying fundamentals of corporate earnings growth. Long-term investors should avoid making significant equity allocation decisions based on expectations or announcements made in the Budget,” said Anoop Vijaykumar, Investments & Head of Research, Capitalmind, in a release published earlier this month.

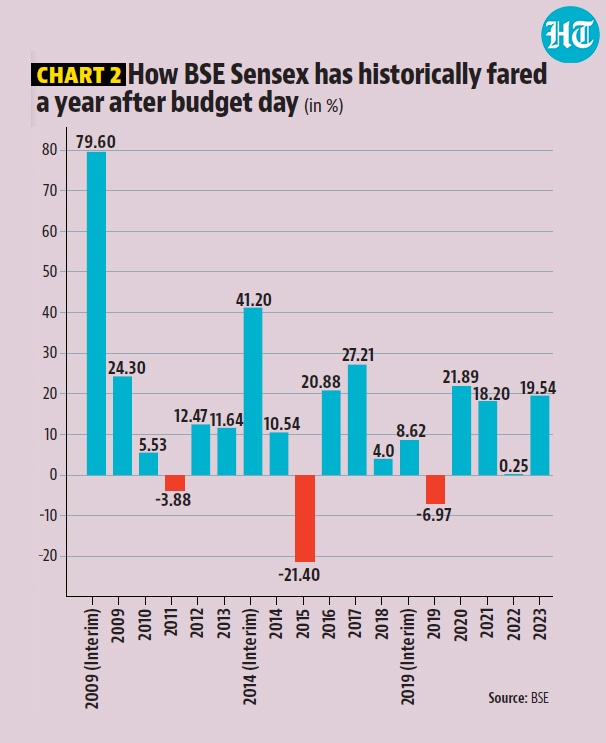

Data shows that among the budgets analysed, only three saw the Sensex trailing a year after the budget day. The years 2011-12, 2015-16 and 2019-20, which saw a fall in Indian markets, were also marked by sluggish growth in the global economy.

“Anyone with an investing horizon of 10+ years should not be fretting about what will likely be announced in the July 2024 budget. There is no better alternative to staying invested and continuing to add, especially on declines,” said Vijaykumar.