In this case, which was heard by the ITAT Delhi bench, Devi Dayal was deputed by his employer – an Indian company engaged in digital technologies – to work on a project in Austria. The salary and compensatory allowance were both paid to him overseas by the Indian company. The allowance could be utilised by Dayal through a credit card that was valid only in Austria.

During assessment for FY16, the I-T official added Rs 21.8 lakh to the income taxable in India, as the taxpayer had not furnished the tax residency certificate (TRC).

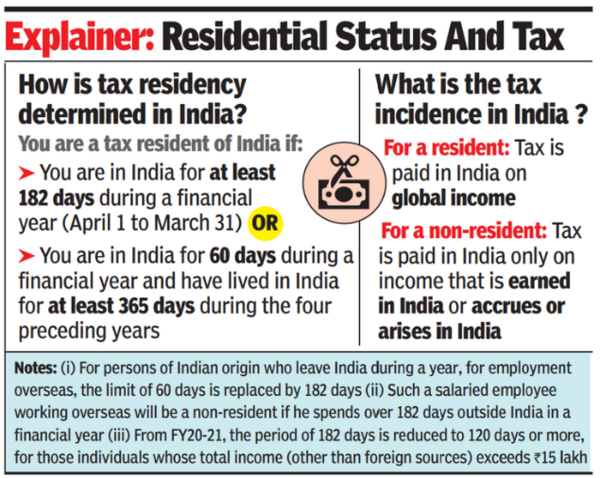

While an Indian residing abroad is popularly referred to as an NRI, the nomenclature is different under tax laws. It is not the country of origin, but the number of days’ stay in India, which determine whether a person will be a resident or non-resident for tax purposes (see table).

Resident individuals are taxable in India on their global income, irrespective of where it was earned. In simple words, in the case of non-residents, only income that accrues or arises in India (say, bank interest from a savings account in India, or rental income from a house in Mumbai) is treated as taxable in the country (see table). Thus, salary received by non-residents in a bank account overseas, for services performed outside India, is not subject to tax in India.

According to Amarpal Singh-Chadha, tax partner and India mobility leader at EY-India, “Despite various favourable rulings, there are instances where tax authorities, especially at lower levels, seek to deny exemption for salary received outside India. They generally try to litigate the matter on various accounts such as non-furnishing of the TRC from the host country or proof of taxes paid in the host country, or even challenge the taxability of the income received outside India based on the existence of employer and employee relationship with the employer in India.”

He adds that a TRC is a mandatory document required to be furnished by a non-resident taxpayer who claims any exemption or benefits under a tax treaty between India and the relevant foreign country. This certificate serves as proof that the taxpayer is a resident of the host country. “In the present case, as exemption was not claimed under the tax treaty, it was not mandatory to furnish the TRC.”

A chartered accountant who is part of a tax team in a company with global operations states that litigation often arises in case of split-contracts, where I-T officials seek to tax that portion of the salary which is deposited in a bank account in India. Under split contracts, the employee is transferred on the payroll of the overseas parent or group company, which pays the base salary and certain allowances in the overseas country. However, the Indian company deposits a part of the salary in the employee’s bank account in India. This enables the employee to meet certain obligations in India – such as repayment of housing loan or household expenses (as the family could be in India). Judicial rulings have held that for a non-resident providing services outside India, even the portion of the salary paid into a bank account in India is not taxable.