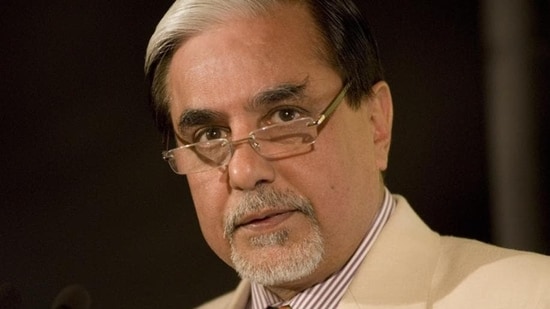

The Securities and Exchange Board of India in its interim order on Monday barred Essel Group chairperson Subhash Chandra along with Zee Entertainment Enterprises Ltd (ZEEL) managing director and chief executive officer Punit Goenka from holding the position of a director or key managerial position in any listed company for allegedly siphoning off funds of the media firm.

The market regulator stated that Chandra and Goenka ‘alienated’ the assets of ZEEL and other listed companies of the media conglomerate for the benefit of associate entities which are owned and controlled by them.

The SEBI order also pointed out that the siphoning of funds appeared to be a well-planned scheme since in some instances, the layering of transactions involved using as many as 13 entities as pass-through entities within a short period of two days only.

As per SEBI, the share price of ZEEL came down from a high of close to ₹600 per share to the present price of less than ₹200 per share during financial year 2018-19 to 2022-23.

“This erosion of wealth despite the company being so profitable and generating profit after tax consistently would lead to a conclusion that all was not well with the company”, the market regulator added. The promoter shareholding dropped from 41.62 per cent to 3.99 per cent.

Noting that the promoter family holds only 3.99 per cent shares in ZEEL, both Chandra and Goenka are still at the helm of affairs of ZEEL. SEBI alleged that the duo made sham entries to misrepresent to the investors and regulator that money had been returned by associate entities. But it was ZEEL’s funds which were allegedly rotated via multiple layers to finally end in the media company’s account.

SEBI had carried out a probe after resignation of two independent directors Sunil Kumar and Neharika Vohra in 2019. Prior to resignations, they had expressed concerns over several issues including appropriation of certain Fixed Deposit (FD) of ZEEL by Yes Bank for squaring off loans of related entities of Essel Group. Vohra had alleged that the bank guarantees were given to a subsidiary without approval from ZEEL’s board.