Anecdotal accounts of dairy products being unavailable in markets combined with high inflation for milk and milk products, recent speculation about the government allowing milk imports, and its subsequent refutation by the animal husbandry secretary of the government of India have created a lot of buzz about a possible supply chain disruption in India’s dairy sector. The fact that these events have followed the outbreak of the lumpy skin disease (LSD) among cattle – it is estimated to have killed tens of thousands of animals – makes theories of damage to production capacity more credible. What can official data tell us about the state of dairy production and a crisis (or lack of it) in India? Here are charts which try and answer this question.

Has milk production fallen sharply in 2022-23?

IIP data shows a fall, but it’s not the first time.

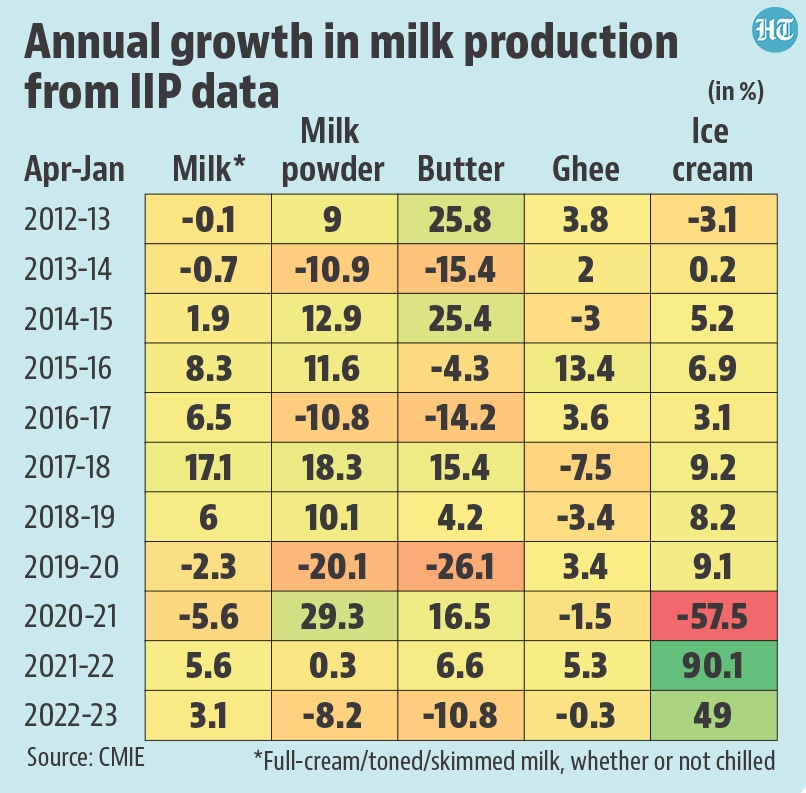

India’s National Dairy Development Board (NDDB) publishes statistics for annual production of milk on its website. However, the latest available numbers on the NDDB’s website are for 2019-20. Another official source of data on milk production is in Index of Industrial Production (IIP) numbers, which publish monthly data on physical quantity of milk, milk powder, butter, ghee and ice cream. IIP numbers are available until January 2023. A comparison of data from April 2022 to January 2023 shows a contraction in production of milk powder, butter and ghee out of these five categories. To be sure, neither is the contraction a first-time affair in the series which begins in 2011-12, nor is its extent the biggest ever.

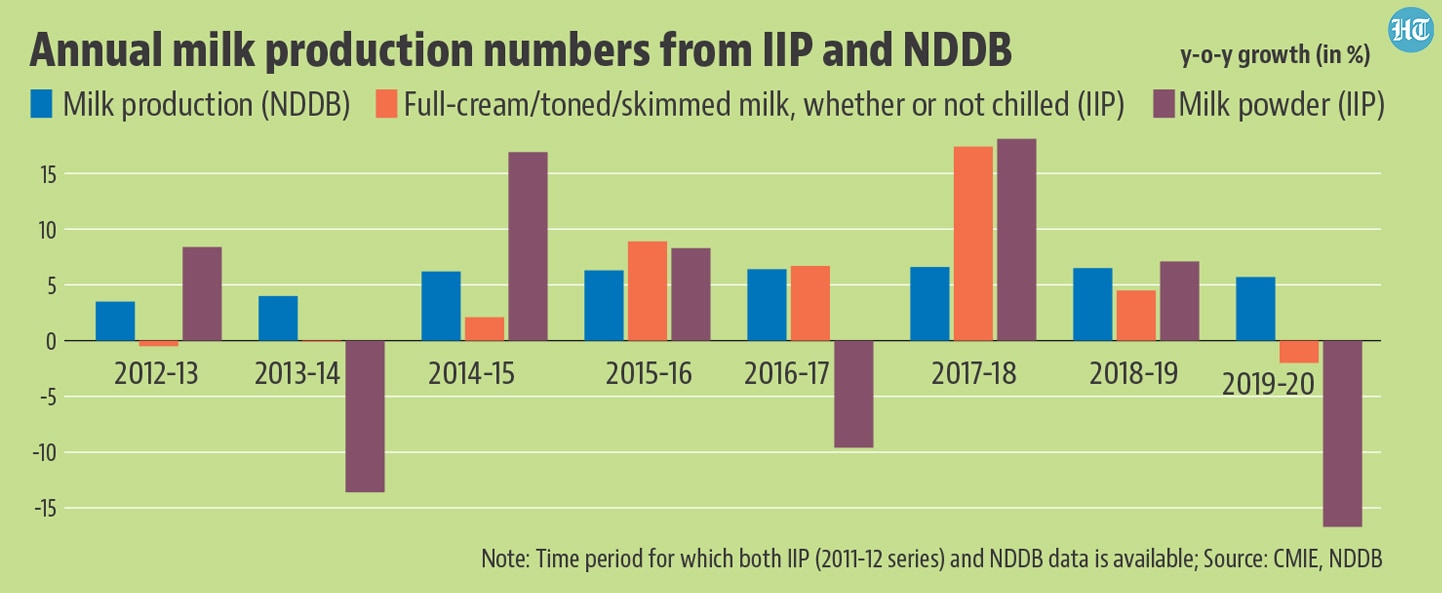

But IIP and NDDB data have not aligned in the past

To be sure, IIP numbers, especially at a high level of disaggregation are not believed to be free from problems. A comparison of IIP numbers on milk production with NDDB numbers shows this clearly. While IIP numbers show a fall in production of milk and related products in more than one year since 2012-13, NDDB data shows a continuously increasing trend throughout. One of reasons for this discrepancy could be the fact that IIP captures milk production which reaches processing units (IIP is a survey of industrial units) and large-scale dairies whereas NDDB’s estimation is on a wider scale. However, the point about discrepancy in data remains.

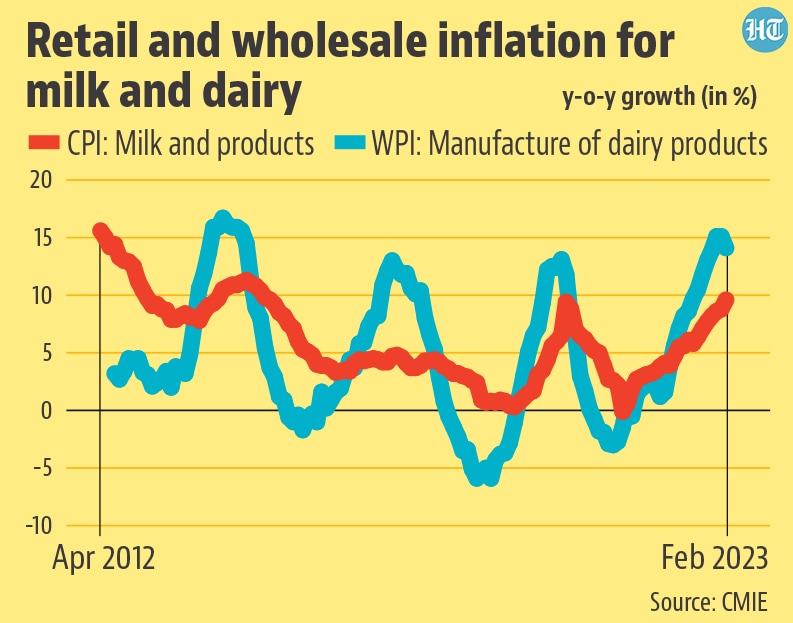

Is the current spike in milk inflation unprecedented?

No, if one goes by retail and wholesale inflation data for milk and milk products in the past. Consumer Price Index (CPI) for milk and products grew at 9.8% on an annual basis in the month of February 2023. While this is the highest monthly inflation since February 2015, milk inflation was in double digits for a year between 2014 and 2015. Wholesale Price Index (WPI) for dairy products was at 17% in February 2023. Here too, inflation has been higher in the past, and unlike in the case of retail inflation, wholesale inflation for dairy seems to have peaked and is now coming down.

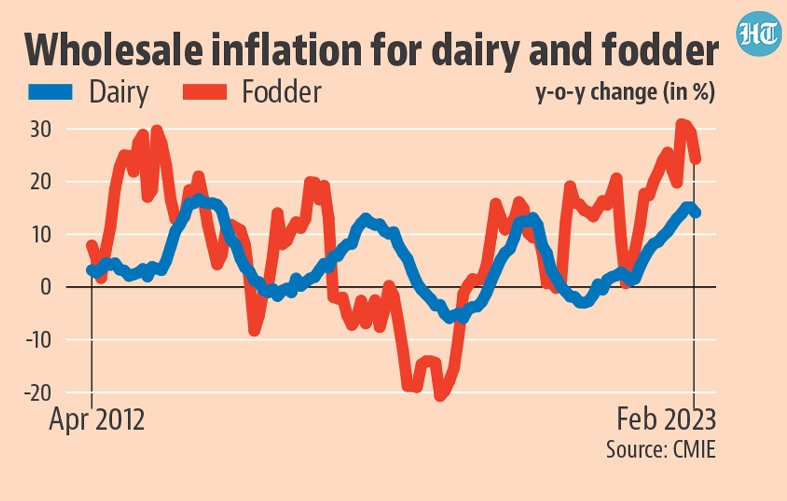

Fodder inflation data shows that LSD’s shock is not the only factor for spike in milk prices

Fodder inflation, as seen in WPI, has been in double digits for 13 consecutive months now, and it grew at 24.3% on an annual basis in the month of February. When read with wholesale inflation for dairy products, there seems to be a close connection between rise in fodder and dairy product inflation. This suggests that part of recent dairy inflation is cost-push rather than driven by just a fall in production due to loss of cattle by LSD.

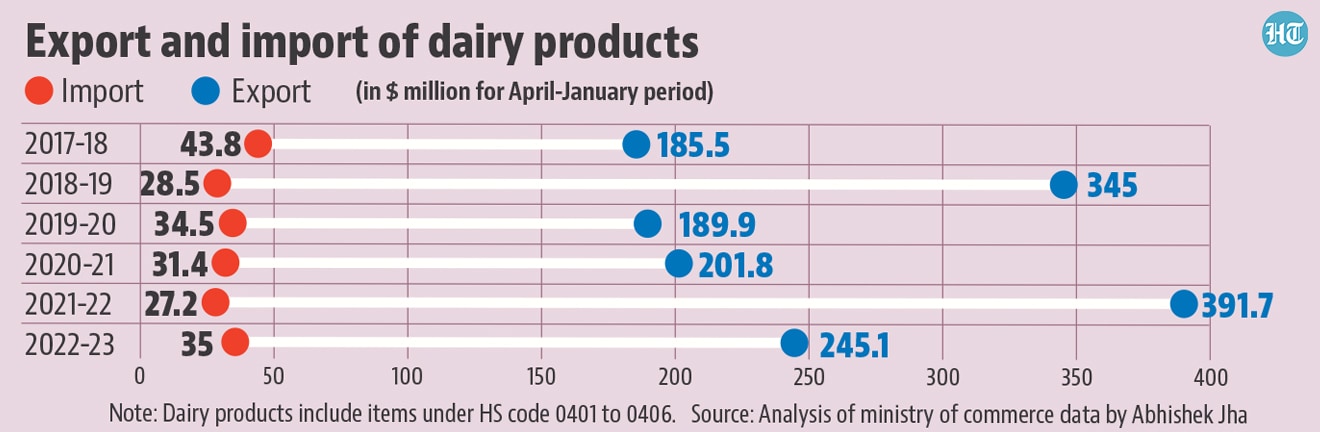

So far there is nothing extraordinary about dairy trade

Has a sudden surge in dairy exports led to a shortage for domestic consumption? An HT analysis of trade data for April-January period from the ministry of commerce does not suggest this. In fact, total dairy exports in 2022-23 fell by more than $100 million compared to the same period last year.

What explains the shortage of dairy products and the speculations around need for large scale imports? This is one of the rare occasions, where we need to think whether government’s datasets are being able to capture a correct picture of the situation at hand.