Month: February 2026

India’s macro fundamentals strong, show notable improvement in recent years: RBI DG Poonam Gupta

Most of India’s key macroeconomic indicators have remained in a healthy range over the last four decades with notable improvement in recent years, said Poonam…

India-GCC FTA: Piyush Goyal signs Joint Statement for trade pact with Gulf Cooperation Council

India and the Gulf Cooperation Council (GCC) signed the Joint Statement for a free trade agreement (FTA) on Monday, marking a major step towards deeper…

Tata Sons defers vote on Chairman Chandra’s new term in sign of power tussle| Business News

The board of Tata Sons Pvt. Ltd. deferred a decision on granting a third term to Chairman Natarajan Chandrasekaran, people familiar said, in the latest…

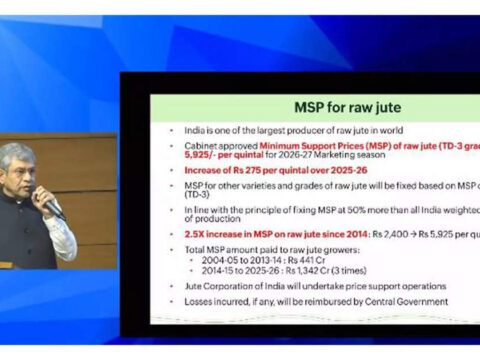

Centre hikes raw jute MSP to Rs 5,925 for 2026-27 season

New Delhi: The Union Cabinet on Tuesday approved a hike in the Minimum Support Price (MSP) of raw jute by Rs 275 to Rs 5,925…

Indian IT set clock high single-digit growth in FY26 despite AI threat| Business News

India’s IT sector is expected to grow in the high single digits in the ongoing fiscal and the next, even as AI threatens to structurally…

Livspace CBO Lalit Mittal quits amid layoffs, cofounder exit

Home decor startup Livspace’s chief business officer (CBO) Lalit Mittal has left the firm following cofounder Saurabh Jain’s exit. “We can confirm that Lalit Mittal,…

Why were IT stocks down today? Fears of AI-led disruption behind Sensex, Nifty drop| India News

IT stocks were among the laggards in the Sensex and Nifty drop on Tuesday, a slump of nearly one per cent in early trade that…

India to overhaul GDP data for a clearer picture of the state of the economy| Business News

India is set to overhaul how it calculates real GDP growth under a revised national accounts series due to launch this week, the country’s top…

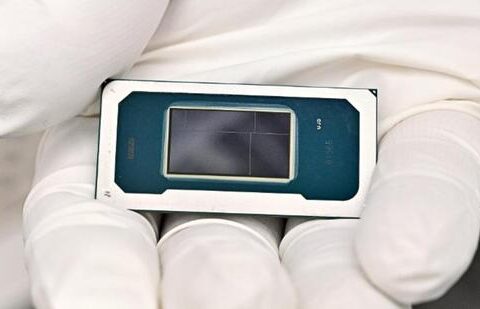

Panther Lake delivers Intel’s biggest generational chip leap in years| Business News

Stakes are high, not just for Intel, but also for every PC maker in the Windows ecosystem, as it battles not just a factual but…

Indian textile exporter Gokaldas expects margin lift after US trade deal

Indian textile maker Gokaldas Exports , a supplier to Walmart, sees pressure on its core earnings margins easing in fiscal 2027 as lower U.S. tariffs…